Your parents are considering investing in David Jones Ltd (DJS) shares. They ask you, an accounting expert,

Question:

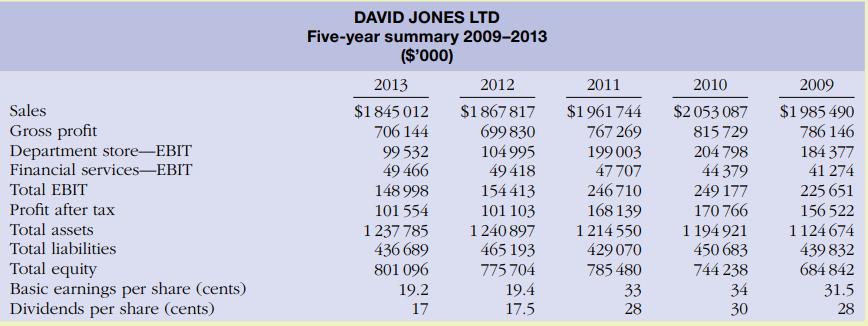

Your parents are considering investing in David Jones Ltd (DJS) shares. They ask you, an accounting expert, to make an analysis of the entity for them. An extract from the five-year summary included in David Jones Ltd 2013 annual report is presented below. All figures are in thousands.

Required

(a) Prepare a 5-year trend (horizontal) analysis of sales, gross profit, department store EBIT, financial services EBIT and profit after tax using 2009 as the base year. Comment on the significance of the trend results.

(b) Calculate the following for 2013 and 2012:

1. Debt to total assets ratio.

2. Profit margin.

3. Asset turnover.

4. Return on shareholders’ equity.

5. Dividend payout.

(c) How would you evaluate David Jones Ltd’s profitability, solvency and investment potential?

(d) What other information may be useful in making a decision about investing in David Jones Ltd (DJS) shares?

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong