a. Calculate EVA for 2020 and 2019, using a cost of capital of 12 percent. No adjustments

Question:

a. Calculate EVA for 2020 and 2019, using a cost of capital of 12 percent. No adjustments for accounting distortions are needed. Explain why sales and income have increased substantially in 2020 and yet EVA is negative. What is not captured in income that is captured in EVA?

b. The owners realize they must cut back on inventory to earn a zero or positive EVA in the coming year. To get a handle on this, they would like you to calculate the maximum amount of inventory that could have been on hand at the end of 2020 for the company to achieve a zero level of EVA.

c. Assume the average car has a cost of $75,000. Also assume that sales, expenses, assets (except inventory), and liabilities are roughly the same in 2021 as in 2020. How many cars must be cut from inventory to achieve zero EVA in 2021?

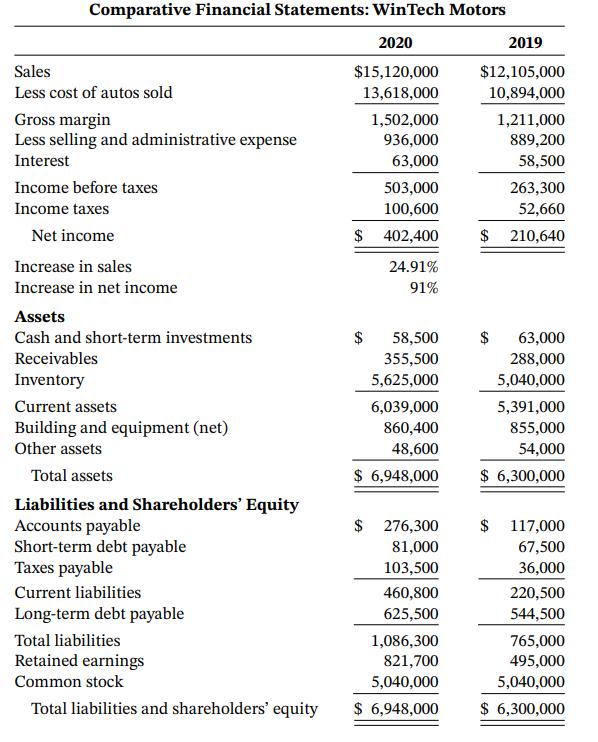

In 2019, five retired software developers opened an auto dealership in Redmond, Washington, which they named WinTechMotors. The company specializes in high-end sports and luxury autos and has one of the largest inventories of used Porsches on the West Coast. (Typically, 75 Porsches are in stock). The inventory is listed on the company’s website and the company has shipped cars to online customers as far away as Florida, although most customers are located in Washington, Oregon, and California. In 2020, an industry publication (Motor Watch) listed WinTech as the fastest-growing luxury auto dealership on the West Coast. Comparative income statements and balance sheets are presented in the table on the right. As indicated, the company had sales of $15,120,000 in 2020 (a 25 percent increase over 2019) and net income of $402,400 (a 91 percent increase over 2019). The owners were delighted with the company’s financial performance and quite proud that they had developed a successful business. However, at a recent meeting, their company’s external accountants introduced them to the concept of EVA and noted that, with an assumed weighted average cost of capital of 12 percent, their EVA had been negative in both years. Accordingly, the owners have contracted with an EVA consultant to help them with financial planning.

Step by Step Answer: