BKZ Ltd is a new company about to launch its business-to-business service on the Internet. The launch

Question:

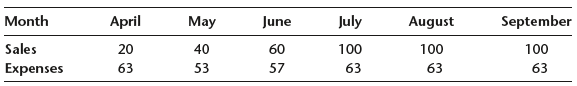

BKZ Ltd is a new company about to launch its business-to-business service on the Internet. The launch will take place in April and it hopes to achieve monthly sales of £100,000 in only four months! Most of its sales will be on credit terms and, based on their experience, its directors expect customers to pay as follows: 30% in the month of sale, 50% one month after sale, 15% two months after sale with 5% lost as bad debts. BKZ does not carry any stock and it intends to pay all its expenses in the month they are incurred. At the beginning of April, after paying for its fixed assets, it will have a positive bank balance of only £2,000. However, its bank has agreed to give it an overdraft (secured against its assets) with a limit of £40,000. Extracts from its budget for the first six months of trading are shown below (all figures in £000). Depreciation of £13,000 a month is included in the expenses figures.

Tasks:1 Based on the information given above, what will the overdraft be at the end of each month? Comment on your answer.2 The financial director suggests offering a cash discount of 10% to customers paying on the day of sale. He believes this will be sufficient to attract many customers who would otherwise pay after one month. Customers are now expected to pay as follows: 60% in the month of sale, 20% one month after sale, 15% two months after sale with 5% lost as bad debts. What will the overdraft be at the end of each month? Advise BKZ how it could manage its working capital to solve its problems.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor