Question: Lewington Ltd makes a variety of kitchen fittings and equipment. It uses a three-stage process involving cutting, assembly and finishing. The following figures are extracted

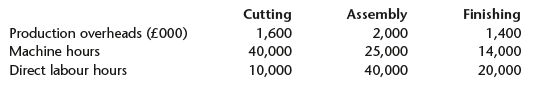

Lewington Ltd makes a variety of kitchen fittings and equipment. It uses a three-stage process involving cutting, assembly and finishing. The following figures are extracted from its budget for the current year:

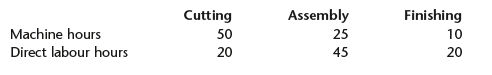

The company uses an absorption costing system for calculating its costs. A batch of 300 ‘DX’ workstations has just been produced using £3,300 of materials, £4,500 of direct labour and the following quantities of time:

Tasks:Calculate the unit production cost and the total production cost of the batch of ‘DX’ workstations using the following three alternative bases:1. Departmental overhead absorption rates are calculated on a machine hour basis.2. Departmental overhead absorption rates are calculated on a direct labour hour basis.3. The Cutting overhead absorption rate is calculated on a machine hour basis but theAssembly and Finishing rates are calculated on a direct labour hour basis.Comment on your findings.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

1 Machine hour rates 3300 Direct materials 4 500 Direct labour Total direct costs ... View full answer

Get step-by-step solutions from verified subject matter experts