MN plc has a rolling programme of investment decisions. One of these investment decisions is to consider

Question:

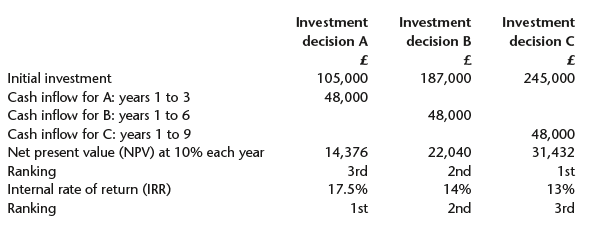

MN plc has a rolling programme of investment decisions. One of these investment decisions is to consider mutually exclusive investments A, B and C. The following information has been produced by the investment manager.

Required:a) Prepare a report for the management of MN plc which includes:

• A graph showing the sensitivity of the three investments to changes in the cost of capital;

• An explanation of the reasons for differences between NPV and IRR rankings – use investment A to illustrate the points you make;

• A brief summary which gives MN plc’s management advice on which project should be selected. (18 marks)

b) One of the directors has suggested using payback to assess the investments. Explain to him the advantages and disadvantages of using payback methods over IRR and NPV. Use the figures above to illustrate your answer.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor