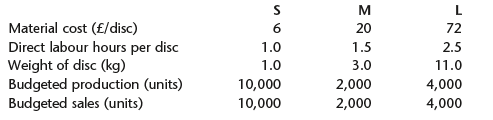

Pullman Products manufactures ceramic discs for industrial use. It makes the discs in three sizes: small (S),

Question:

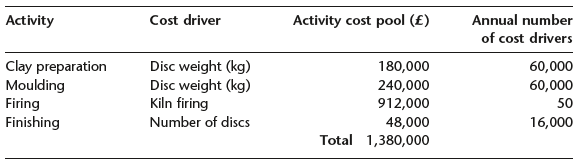

All direct labour is paid at £6/hour. The budgeted fixed production overheads total £1,380,000. Selling prices are calculated by adding 150% to the production cost. Fierce competition from the Far East is forcing Pullman to review its selling prices, especially on its small disc. The recently appointed production manager has suggested that the use of activity-based costing may throw some light on this problem. To test the feasibility of this suggestion, a crude analysis of the firm€™s production overhead activities has been carried out and the results are shown below.

In the budget period, there were 15 firings for small discs, 5 firings for medium discs and 30 firings for large discs.

Task:

For each disc, calculate the unit production cost and selling price using:

a) the absorption costing system;

b) the activity-based costing system.

Comment on your findings.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor