The Concord Toy Company has two separate strategic business units. A draft plan, incorporating a target return

Question:

The Concord Toy Company has two separate strategic business units. A draft plan, incorporating a target return on capital employed (ROCE) of 20% per annum, has been created by the managing director. Aware that the toy industry is a volatile one, the board of directors wishes to review the flexibility of the profit forecast shown by the plan. In preparation for the board meeting to discuss the plan, certain questions have been posed for each operating unit (see below).

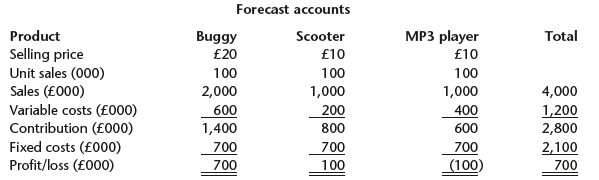

Operating Unit 1 – novelty pensThis unit produces novelty pens. Most of these are based on popular cartoon characters. Variable costs are taken as raw materials and royalties. All other costs are assumed to be fixed in the short term. The following forecasts have been made:Selling price per pen............................................................... £2Variable cost per pen......................................................... £1.50Sales revenue................................................................ £800,000Average capital employed........................................... £300,000Within the output range 300,000 to the maximum capacity of 450,000 pens, the fixed costs are £150,000.Operating Unit 2 – dolls’ accessoriesThis unit produces three main products – a doll’s buggy, a doll’s scooter and a doll’s MP3 player. In the past, the company has exported most of its products but, in its drive to develop home sales, it has recently obtained a contract to supply a national chain store. The store’s toy buyer has requested the company to supply a doll’s convertible car in addition to its existing products.

Fixed costs are apportioned on the basis of unit sales. The average capital employed is estimated at £3.6 million. To make a doll’s convertible car would require new plant, financed in full by a bank loan.Tasks re Unit 1:1. What is the break-even point in sales volume and value?2. What is the margin of safety shown by the forecast?3. Will the operating unit achieve a 20% return on capital employed?4. What will be the profit if production output increases to maximum capacity? Qualify your answer.5. How many pens must be sold to make a profit of £60,000?6. What actions can be taken to improve profitability?Tasks re Unit 2:1. Will this operating unit achieve a 20% return on capital employed on the existing sales forecast?

2. If the sales mix remains at equal volumes of the three products, what is the break-even point in sales volume and value?3. What will the operating profit be if the sales volume on each product fallsa) 10% below forecast?b) 20% below forecast?4. Should Concord stop producing and selling the MP3 player?5. Should the selling price of the MP3 player be increased to £12 to cover the full costs?6. What further information is required to decide whether or not to make a doll’s convertible car?

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor