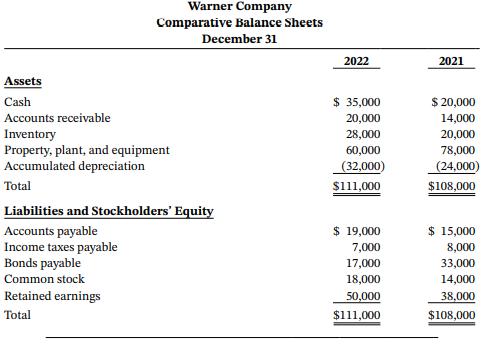

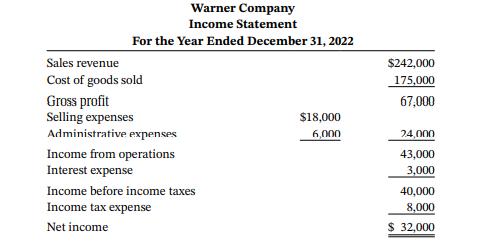

Presented here are the financial statements of Warner Company. Additional data: 1. Depreciation expense was $17,500. 2.

Question:

Presented here are the financial statements of Warner Company.

Additional data:

1. Depreciation expense was $17,500.

2. Dividends declared and paid were $20,000.

3. During the year, equipment was sold for $8,500 cash. This equipment originally cost $18,000 and had accumulated depreciation of $9,500 at the time of sale.

4. Bonds were redeemed at their carrying value.

5. Common stock was issued at par for cash.

Instructions

a. Prepare a statement of cash flows using the indirect method.

b. Compute free cash flow.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting Tools For Business Decision Making

ISBN: 9781119709589

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell

Question Posted: