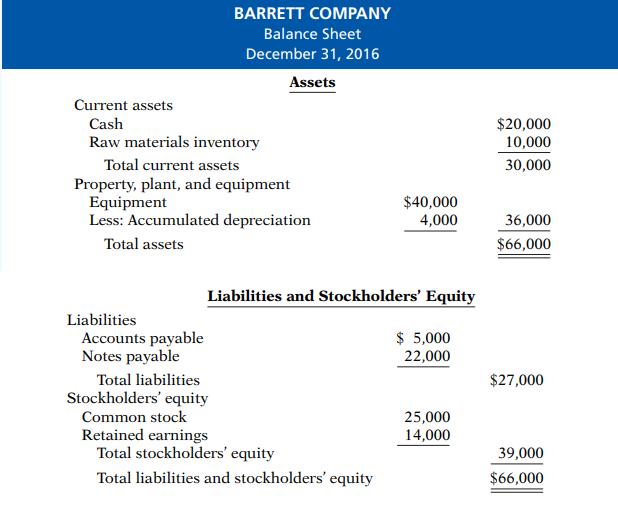

Barrett Company has completed all operating budgets other than the income statement for 2017. Selected data from

Question:

Barrett Company has completed all operating budgets other than the income statement for 2017. Selected data from these budgets follow.

Sales: $300,000

Purchases of raw materials: $145,000

Ending inventory of raw materials: $15,000

Direct labor: $40,000

Manufacturing overhead: $73,000, including $3,000 of depreciation expense

Selling and administrative expenses: $36,000 including depreciation expense of $1,000 Interest expense: $1,000

Principal payment on note: $2,000

Dividends declared: $2,000

Income tax rate: 30%

Other information:

Assume that the number of units produced equals the number sold.

Year-end accounts receivable: 4% of 2017 sales.

Year-end accounts payable: 50% of ending inventory of raw materials.

Interest, direct labor, manufacturing overhead, and selling and administrative expenses other than depreciation are paid as incurred.

Dividends declared and income taxes for 2017 will not be paid until 2018.

Instructions

(a) Calculate budgeted cost of goods sold.

(b) Prepare a budgeted multiple-step income statement for the year ending December 31, 2017.

(c) Prepare a budgeted classified balance sheet as of December 31, 2017.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9781118957738

7th International Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso