Giza Farms in Cairo, Egypt, has a corporate headquarters staff and three operating divisions: consulting services, chemicals,

Question:

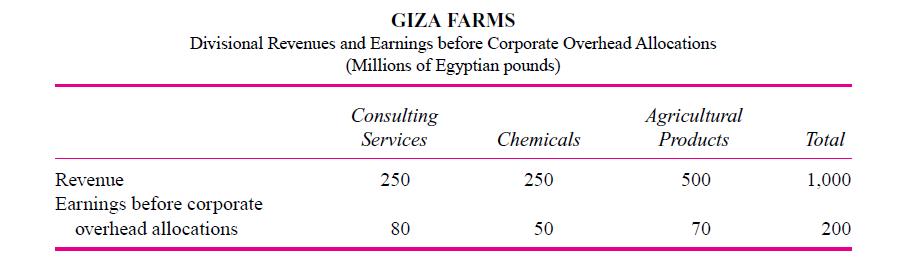

Giza Farms in Cairo, Egypt, has a corporate headquarters staff and three operating divisions: consulting services, chemicals, and agricultural products. Giza is considering allocating 160 million Egyptian pounds of corporate overhead (which includes salaries and benefits of corporate headquarters staff, advertising, human resources, legal, and so forth) to the three divisions using either divisional revenues or divisional earnings before corporate overhead allocations as the allocation base.

(One Egyptian pound is worth about $0.30.) The following table describes the revenues and earnings before corporate overhead allocations for each of the three operating divisions.

Required:

a. Calculate divisional earnings after corporate overhead allocations using divisional revenues as the allocation base.

b. Calculate divisional earnings after corporate overhead allocations using divisional earnings before corporate overhead allocations as the allocation base.

c. Given that overhead will be allocated to the division, should revenue or earnings be the allocation base? Why?

d. After reviewing the data from parts (a) and (b), all three divisional managers were critical of the decision to allocate corporate overhead, but the manager of agricultural products was particularly outspoken. She said, “This is just another hair-brained scheme of the [expletive deleted]. They have nothing better to do with their time than to push numbers around. We in the divisions have no control over corporate spending and all these allocations do is create dissension among the divisional managers and distort the true relative profitability of the divisions.” Respond to the agricultural products manager’s remarks.

Step by Step Answer:

Accounting For Decision Making And Control

ISBN: 9780078136726

7th Edition

Authors: Jerold Zimmerman