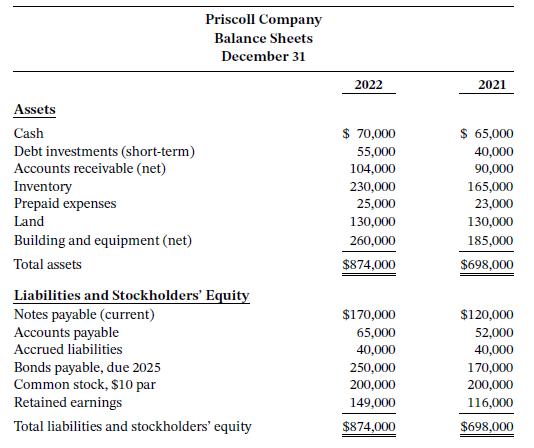

The following financial information is for Priscoll Company. Additional information: 1. Inventory at the beginning of 2021

Question:

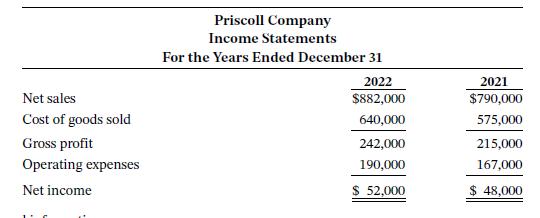

The following financial information is for Priscoll Company.

Additional information:

1. Inventory at the beginning of 2021 was $115,000.

2. Accounts receivable (net) at the beginning of 2021 were $86,000.

3. Total assets at the beginning of 2021 were $660,000.

4. No common stock transactions occurred during 2021 or 2022.

5. All sales were on credit.

Instructions

a. Compute liquidity and profitability ratios, and indicate the percentage change (to the nearest whole percentage) in liquidity and profitability ratios of Priscoll Company from 2021 to 2022.

b. The following are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2022, and (2) as of December 31, 2023, and percentage change in each ratio after giving effect to the situation

1. 18,000 shares of common stock were sold at par on July 1, 2023. Net income for 2023 was $54,000, and there were no dividends. Return on common stockholders’ equity

2. All of the notes payable were paid in 2023. All other liabilities remained at their December 31, 2022, levels. Total assets on December 31, 2023, were $900,000. Debt to assets ratio

3. The market price of common stock was $9 and $12 on December 31, 2022 and 2023, respectively. Net income for 2023 was $54,000.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9781119754053

9th Edition

Authors: Jerry J Weygandt, Paul D Kimmel, Jill E Mitchell