Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a

Question:

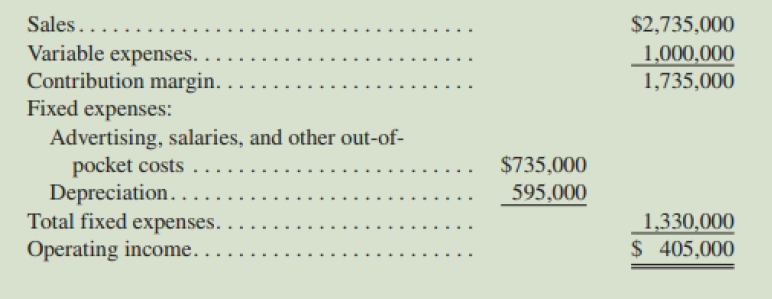

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows:

Required:

If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's payback period to be higher than, lower than, or the same as your answer to requirement 7? No computations are necessary.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby

Question Posted: