Claire Jackson (CEO) of Easy Learning (EL) is considering discontinuing operations in South America, which are based

Question:

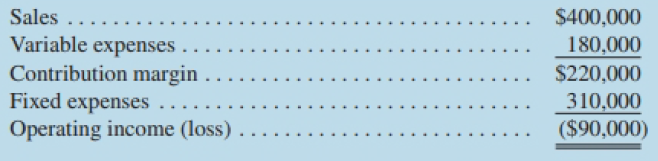

Claire Jackson (CEO) of Easy Learning (EL) is considering discontinuing operations in South America, which are based in Argentina. For a variety of reasons it has been a challenge for EL to grow the business in this region and costs continue to rise because of high inflation. Results from the most recent fiscal year just ended are shown below.

If the South American operations are discontinued, Jackson has identified the following implications:

1. Assets with an original cost of $485,000, mostly leasehold improvements and computer equipment, can be sold for S 15,000. Assume that the assets are completely written off for both accounting purposes and tax purposes (i.e., $0 NBV and UCC) and that the salvage proceeds of $ 15,000 are not taxable.

2. Severance pay for the three full-time employees will total $50,000. Severance pay is a tax deductible expense.

3. Of the total annual fixed expenses of $310,000, $40,000 represents an allocation from head office for computer support and will continue to be incurred even if the South American operations are discontinued.

4. The corporate tax rate in Argentina is 35%. Jackson is also considering the option of trying to make the South American operations profitable. She believes that with more emphasis on marketing and sales, EL could be successful. Details and assumptions made by Jackson for this option are as follows:

1. To increase sales, an additional marketing specialist would be hired immediately at an annual cost of $110,000 including benefits. This is $20,000 higher than the next highest paid employee in EL's Argentina office.

2. The new marketing specialist should be able to acquire two new customers in each of the next two years and each customer will generate annual revenue of $100,000. One additional new customer will be acquired each year thereafter and each will generate annual revenue of $100,000.

3. Hiring a new marketing specialist will necessitate the purchase of office furniture with a total cost of $5,000. The CCA rate in Argentina for office furniture is 10%. Assume there is no CCA half year rule in Argentina.

4. EL will not Jose any existing customers over the next five years and will be able to retain all newly acquired customers over that same period. This contrasts with the typical churn rate for high-tech companies of about 20% per year.

5. Variable expenses will continue at the same rate as in the most recent fiscal period for the next five years.

6. The marketing specialist will receive a commission of 10% of revenue generated from new customer acquisitions.

7. Existing total fixed expenses of $310,000 per year, including the $40,000 allocation from head office for computer support, will be unchanged for the next five years.

Required:

1. Should the South American operations be discontinued or should Jackson hire a new marketing specialist in an attempt to grow the business? Because of the uncertainty in the South American operating environment, Jackson wants you to prepare your analysis of the two options for a five year period. EL has a required return of 12%.

2. Regardless of your recommendation for part I, what qualitative factors should Jackson consider when deciding whether or not to discontinue operations in South America?

3. Assume that the marketing specialist will be able to acquire two new customers in the first year, but thereafter only one new customer will be acquired each year. Each new customer will generate annual revenue of $100,000. Given this new assumption, revise your analysis of the option to continue operations in South America. Assume all other details and assumptions regarding this option remain unchanged. Should the operations be discontinued or should the new marketing specialist be hired?

4. What do the results of the revised analysis in part 3 above suggest about the riskiness of the option to hire a new marketing specialist? How could this risk be incorporated in your analysis?

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby