Fanfare Products, Inc., is a manufacturer of mobile devices. Keshunn is the plant manager at Fanfares Toledo,

Question:

Fanfare Products, Inc., is a manufacturer of mobile devices. Keshunn is the plant manager at Fanfare’s Toledo, Ohio, plant. The Toledo plant manufactures a smartphone, the Zoom, which has sold well for the past six months. Keshunn is being considered for promotion to manager of the entire West Coast division of Fanfare Products. Bethany is an accounting supervisor at Fanfare Products and is a good friend of Keshunn’s.

Keshunn and Bethany are having lunch in the company cafeteria. There are about six weeks left in the current fiscal year. Keshunn is concerned that his plant will be showing a loss rather than the healthy profit he had projected for the year. The reason for the shortfall is that demand has radically declined for the Zoom smartphone currently manufactured by Keshunn’s plant. New smartphones with more features have been brought to market by Fanfare’s competitors. Engineers at Fanfare are currently working on an updated model of the Zoom, but it will not be ready for production in Keshunn’s plant for another five months. If Keshunn’s plant shows a loss this year, Keshunn will not receive his performance bonus for the year. He also knows that his chance of promotion to the West Coast manager will be greatly reduced.

Bethany thinks about Keshunn’s situation. She then shares with him a strategy that he can use to help increase his profits. She explains that under absorption costing, the more units in ending inventory, the more costs can be deferred. Using her tablet, she makes up a quick example in Excel to show him how he can turn his situation around and show operating income for the year.

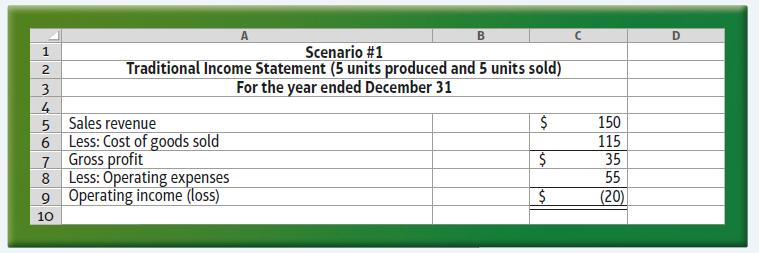

Bethany’s first spreadsheet assumes that five units are produced and sold in this hypothetical situation:

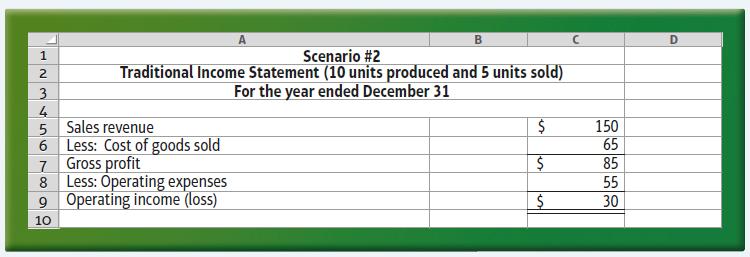

If five units are produced and sold, the hypothetical company would have a loss of \($20\). Now Bethany changes just one fact; instead of producing five units, the company in the example produces ten units. No other facts change—the company still sells just five units. Bethany shows Keshunn the revised income statement under the increased production scenario:

Under this second scenario, the operating income would be \($30,\) which is quite a bit higher than the original scenario. Bethany again emphasizes that the only fact that was different between the two scenarios is that production, and therefore ending inventory, increased in the second scenario.

Bethany then urges Keshunn to put on a major production push in the last month of the year. If he does, he will be able to push his income up to near projected levels. With the higher income, he will receive his annual performance bonus. In addition, he feels that his chances of getting the West Coast manager position are excellent.

Requirements:

1. Using the IMA Statement of Ethical Professional Practice as an ethical framework, answer the following questions:

a. What is (are) the ethical issue(s) in this situation?

b. What are Bethany’s responsibilities as a management accountant?

c. Has Bethany violated any part of the IMA Statement of Ethical Professional Practice? Support your answer.

2. What causes the shift from a loss to a profit in the hypothetical example?

3. What problems, if any, are caused by building inventories at year end?

4. What could Fanfare Products do to prevent future situations like the one described in this case?

Step by Step Answer: