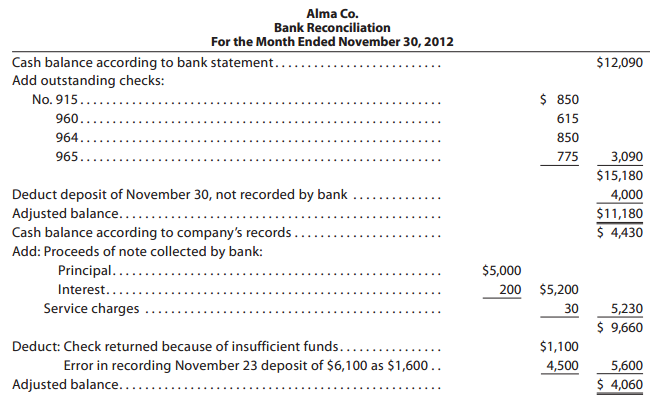

Question: Identify the errors in the following bank reconciliation: Alma Co. Bank Reconciliation For the Month Ended November 30, 2012 Cash balance according to bank statement....

Alma Co. Bank Reconciliation For the Month Ended November 30, 2012 Cash balance according to bank statement.... Add outstanding checks: No. 915.... $12,090 $ 850 960.. 615 964. 850 965.. 775 $15,180 3,090 Deduct deposit of November 30, not recorded by bank Adjusted balance..... Cash balance according to company's records. Add: Proceeds of note collected by bank: 4,000 $11,180 $ 4,430 $5,000 200 $5,200 Principal.. Interest.. Service charges 30 5,230 $ 9,660 Deduct: Check returned because of insufficient funds.... $1,100 Error in recording November 23 deposit of $6,100 as $1,600.. 4,500 5,600 $ 4,060 Adjusted balance....

Step by Step Solution

3.27 Rating (156 Votes )

There are 3 Steps involved in it

1 The heading should be November 30 2012 and not For the Month Ended November 30 2012 2 The outstand... View full answer

Get step-by-step solutions from verified subject matter experts