Kay Kee Limited (KKL) is a company that manufactures customized toy racing cars complete with all kinds

Question:

Kay Kee Limited (KKL) is a company that manufactures customized toy racing cars complete with all kinds of gadgetry. KKL purchases all the components (direct materials) but assembles and finishes the cars in two departments: assembly and finishing. Assembly is a labour-intensive process, whereas finishing is machine intensive. For 2018, KKL has developed the following estimates:

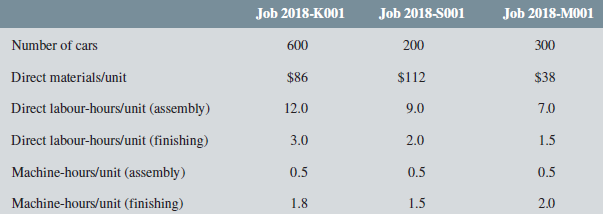

During January 2015, it received and started processing orders from three customers, whose details are as follows:

Assume the direct labour rate during January was the same as estimated at the beginning of the year. During the month, KKL completed jobs 2018-S001 and 2018-M001 but was able to complete only 75% of the units required to complete job 2018-K001. The assembly department incurred overhead amounting to $38,260 during the month, whereas the finishing department incurred $66,560.

Required:

1. Compute the prime costs incurred by each job during the month.

2. Compute the amount of overhead that would have been applied to the jobs during the month in the assembly and finishing departments.

3. Compute the total cost of the jobs completed during the month. What is the amount of work (jobs) in process at the end of the month?

4. Compute the under- or overapplied overhead for the month in each department and in total, labelling as appropriate. How should KKL adjust the over- or underapplied overhead amount in its financial statements for the month?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan