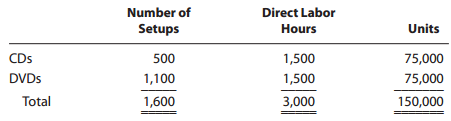

Memory Disk Inc. is considering a change to activity-based product costing. The company produces two products, CDs

Question:

a. Determine the indirect labor cost per unit allocated to CDs and DVDs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base.

b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activities€”one for setup and the other for production support.

c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing.

d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: