Question: Morrow Manufacturing Company uses the weighted average method for process costing. Morrow produces processed food products that pass through three sequential departments. The costs for

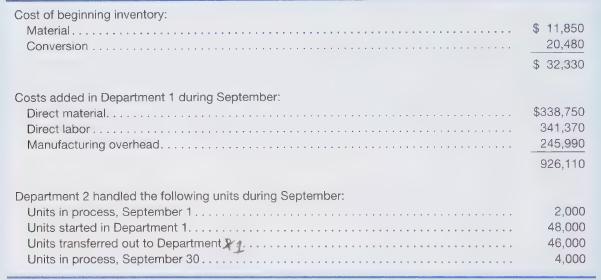

Morrow Manufacturing Company uses the weighted average method for process costing. Morrow produces processed food products that pass through three sequential departments. The costs for Department 1 for September 2016 were as follows:

On average, the September | units were 30% complete, and the September 30 units were 60% complete. Materials are added at the beginning of the process and conversion costs occur evenly throughout the process in Department 1.

Required

Prepare the product cost report for September for Department 1.

Cost of beginning inventory: Material... Conversion. Costs added in Department 1 during September: Direct material... Direct labor... Manufacturing overhead. Department 2 handled the following units during September: Units in process, September 1.. Units started in Department 1. Units transferred out to Department1 Units in process, September 30.. 11,850 20,480 $ 32,330 $338,750 341,370 245,990 926,110 2,000 48,000 46,000 4,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Calculate Equivalent Units Units transferred out to Department 2 during September Completed during S... View full answer

Get step-by-step solutions from verified subject matter experts