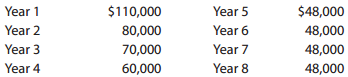

Nations Trust is evaluating two capital investment proposals for a drive-up ATM kiosk, each requiring an investment

Question:

Determine the cash payback period for both location proposals.

Payback PeriodPayback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: