Question: Natures Elixir Corporation operates three divisions that process and bottle natural fruit juices. The historical-cost accounting system reports the following information for 2011: Natures Elixir

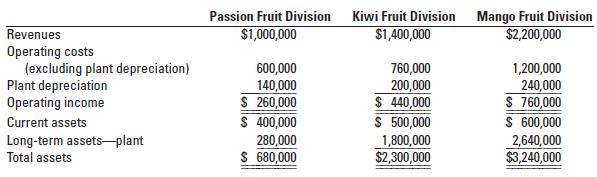

Nature’s Elixir Corporation operates three divisions that process and bottle natural fruit juices. The historical-cost accounting system reports the following information for 2011:

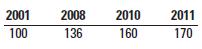

Nature’s Elixir estimates the useful life of each plant to be 12 years, with no terminal disposal value. The straight-line depreciation method is used. At the end of 2011, the passion fruit plant is 10 years old, the kiwi fruit plant is 3 years old, and the mango fruit plant is 1 year old. An index of construction costs over the 10-year period that Nature’s Elixir has been operating (2001 year-end = 100) is as follows:

Given the high turnover of current assets, management believes that the historical-cost and current cost measures of current assets are approximately the same.

1. Compute the ROI ratio (operating income to total assets) of each division using historical-cost measures. Comment on the results.

2. Use the approach in Exhibit 23-2 (p. 817) to compute the ROI of each division, incorporating current-cost estimates as of 2011 for depreciation expense and long-term assets. Comment on the results.

3. What advantages might arise from using current-cost asset measures as compared with historical-cost measures for evaluating the performance of the managers of the three divisions?

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

1 ROI Ratio using HistoricalCost Measures Passion Fruit Division Operating Income 140000 130000 260000 12 years x 2 years 270000 ROI Ratio Operating Income Total Assets 270000 680000 0397 or 397 Kiwi ... View full answer

Get step-by-step solutions from verified subject matter experts