On December 31, 2022, CC is considering launching a new product line and entering a new market.

Question:

On December 31, 2022, CC is considering launching a new product line and entering a new market.

● The new product line would require an infrastructure cost today of $240,000.

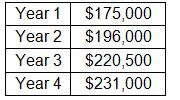

● The anticipated contribution margin from the new product per year is as follows:

● CC anticipates making an additional investment of $60,000 (cash expenditure) toward the end of 2025.

● Yearly additional support costs for the product related to promotion, accounting, and systems work are estimated at $20,000 per year.

● The cost of capital (minimum desired rate of return) for the new product is 10%.

a. Identify the relevant items

b. Using the template, determine the annual cash flows and net present value.

c. Presented below is the after-tax net present value analysis if the cash flows listed before are “before tax.” Compare the NPV below to your analysis in (b).

d. Determine the payback period from the template assuming that the cash flows are before taxes.

e. What other factors would you consider relevant?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope