Precious Glassworks, Inc., produces unique hand-blown glass light fixtures for custom-built homes and uses a job order

Question:

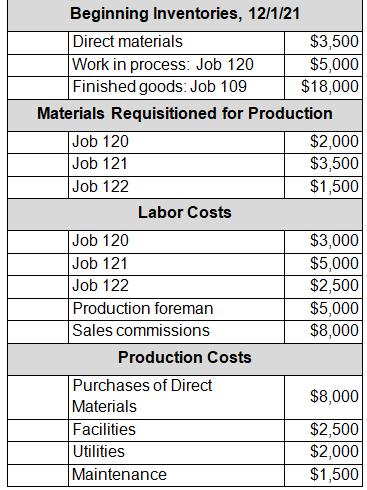

Precious Glassworks, Inc., produces unique hand-blown glass light fixtures for custom-built homes and uses a job order costing system for its production costs. The company bases its predetermined overhead rate on the estimated number of firing hours and uses actual firing hours to apply overhead to individual jobs. Estimated overhead for 2022 is $48,000, and estimated firing hours are 800 for the year.

The following information is for the month of December:

● Firing hours used for each job in December were as follows: 72 hours for Job 120; 100 hours for Job 121; and 88 hours for Job 122.

● On December 1, only Job 120 was in process and only Job 109 was complete.

● During the month, Jobs 120 and 121 were completed.

● Job 121 shipped on December 30, but Jobs 109 and 120 were not shipped until January 2, 2023.

● Job 122 is the only job currently left in production on December 31

Precious Glassworks, Inc., produces unique hand-blown glass light fixtures for custom-built homes and uses a job order costing system for its production costs. The company bases its predetermined overhead rate on the estimated number of firing hours and uses actual firing hours to apply overhead to individual jobs. Estimated overhead for 2022 is $48,000, and estimated firing hours are 800 for the year.

The following information is for the month of December:

● Firing hours used for each job in December were as follows: 72 hours for Job 120; 100 hours for Job 121; and 88 hours for Job 122.

● On December 1, only Job 120 was in process and only Job 109 was complete.

● During the month, Jobs 120 and 121 were completed.

● Job 121 shipped on December 30, but Jobs 109 and 120 were not shipped until January 2, 2023.

● Job 122 is the only job currently left in production on December 31.

a. Compute the predetermined overhead rate.

b. Compute the total overhead costs allocated to all jobs during December.

c. Was overhead underallocated or ove-allocated in the month of December

d. What is the balance of work in process on December 31?

e. Compute the cost of goods available for sale in December.

f. What is the balance of finished goods inventory on December 31?

g. What was the reported cost of goods sold on the income statement for December 31, 2022?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope