Quincy Company has both cash and credit customers. The company expects that 40% of total monthly sales

Question:

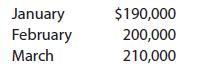

Quincy Company has both cash and credit customers. The company expects that 40% of total monthly sales will be collected in cash in the month of sale, and the remaining 60% will be collected in the month following the month of sale. The Accounts Receivable balance on January 1 is $97,500, all of which is expected to be collected during January. Projected sales for the first three months of the year are as follows:

Projected manufacturing costs and selling and administrative expenses for the first three months of the year are as follows:

Manufacturing costs include depreciation, insurance, and property taxes, which represent $18,000 of the estimated monthly manufacturing costs. The annual insurance premium was paid on December 31 of the prior year, and property taxes for the year will be paid in June. Sixty percent of the remainder of manufacturing costs are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. The Accounts Payable balance on January 1, which consisted entirely of unpaid manufacturing costs from December, is $36,700. All selling and administrative expenses are paid in cash in the period in which they are incurred. The cash balance on January 1 was $26,000, and management desires to maintain a minimum cash balance of $20,000.

Prepare:

a. A schedule of collections from sales.

b. A schedule of cash payments for manufacturing costs.

c. A cash budget.

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9781337902663

15th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William B. Tayler