Refer to the data provided in Problem 6, but assume that the number of units expected to

Question:

Refer to the data provided in Problem 6, but assume that the number of units expected to be sold will equal the number of units expected to be produced. Also assume that Quality Cases manufactures the product rather than buys the finished units. As such, the company would need a schedule of production costs (direct materials, direct labor, overhead). Data include the following facts:

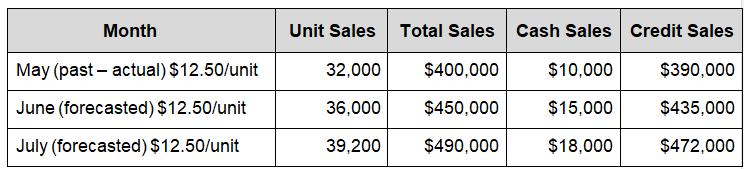

● Each unit is projected to sell for $12.50. Assume the same unit sales and total sales provided earlier.

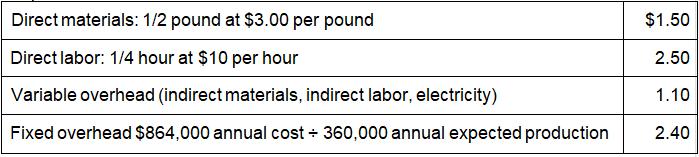

● Cost per unit is estimated at $7.50 as follows:

● The fixed overhead is applied to each unit as it is produced at the rate of $2.40; the monthly budget would consist of the same amount for depreciation, supervisory and administrative fixed salaries, property taxes, insurance, and so on.

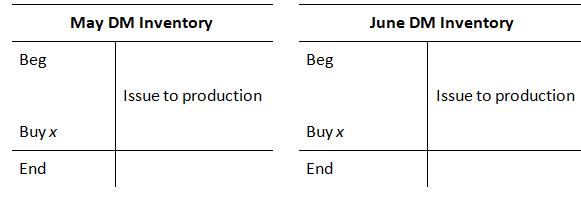

● The company wishes to have 15% of the next month’s direct materials available at the end of each month.

● Direct materials inventory purchases are bought all on credit; half are paid in the month of purchase and half are paid in the following month.

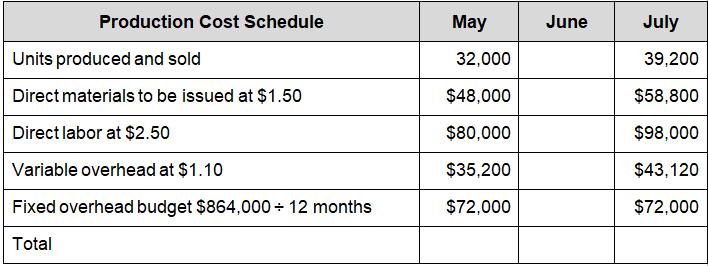

a. Prepare a budgeted manufacturing production cost schedule for June. May and July have been provided as a guide.

b. What are the planned purchases of direct materials for May and June?

c. What are the planned payments to suppliers for June?

d. Describe (without actually calculating) which numbers would change if the company instead produced 37,000 units in June (sensitivity analysis)?

Data from Problem 6.

Quality Cases, a small company that provides services and makes protective cases for phones and tablets, has gathered data to prepare a master budget. Assume the following data for Quality Cases:

Other information:

● The collection policy for credit sales is as follows: 25% in the month of sale; 75% in the subsequent month. The company is aware that some credit sales may not be collected, but believes that amount to be negligible because the salespeople will not sell to customers that do not pay on credit.

● The gross profit ratio is 45% of sales. The inventory policy is to have 5% of the next month’s sales in units (safety stock) available at the end of each month. All purchases are on credit. Seventy percent is paid in the same month of purchase; the remainder is paid in the month following the purchase.

● Selling and administrative salaries for June total $64,000 and will be paid in June. Accrued salaries from May of $8,000 will be paid in June.

● Existing buildings and equipment have a combined cost of $140,000, a useful life of 7 years, and no salvage value. Equipment with a cost of $12,000 is projected to be bought toward the end of June with cash. Land with a book value of $16,000 is projected to be sold for $13,000 in June.

● Rent, insurance, and advertising total $11,500 per month (paid at the end of each month).

● The cash balance on June 1 was $10,000. The June scheduled debt payment of $4,400 includes $400 of interest. The interest expense relates to a $72,000 note payable.

● For simplicity, ignore income taxes. The desired minimum cash balance is $20,000.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope