Question: Refer to the Wolf Valley Data Set in E12-34A. Data in E12-34A. Consider how Wolf Valley, a popular ski resort, could use capital budgeting to

Refer to the Wolf Valley Data Set in E12-34A.

Data in E12-34A.

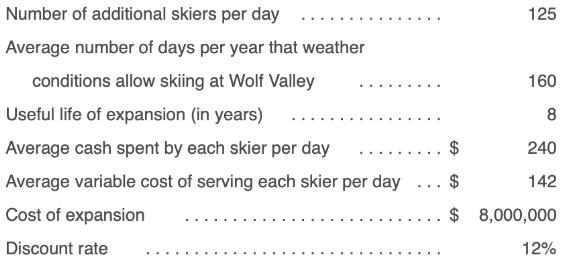

Consider how Wolf Valley, a popular ski resort, could use capital budgeting to decide whether the $8 million Brook Park Lodge expansion would be a good investment.

Requirements

1. What is the project’s NPV? Is the investment attractive? Why or why not?

2. Assume that the expansion has no residual value. What is the project’s NPV? Is the investment still attractive? Why or why not?

Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Wolf Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day ... Cost of expansion $ Discount rate GA 125 160 8 240 142 8,000,000 12%

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

ANSWER 1 The NPV of the project is 3571399 The investment is attractive as t... View full answer

Get step-by-step solutions from verified subject matter experts