Question: Specialty Polymers, Inc., processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the

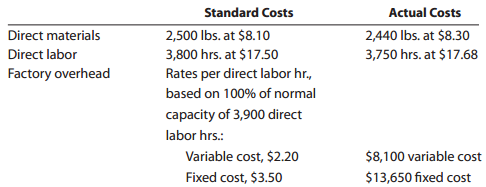

Specialty Polymers, Inc., processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 19,000 units of product were as follows:

Each unit requires 0.2 hour of direct labor.

Determine

(a) The price variance, quantity variance, and total direct materials cost variance;

(b) The rate variance, time variance, and total direct labor cost variance;

(c) Variable factory overhead controllable variance, the fixed factory overhead volume variance, and total factory overhead cost variance.

Standard Costs 2,500 Ibs. at $8.10 3,800 hrs. at $17.50o Rates per direct labor hr., based on 100% of normal capacity of 3,900 direct labor hrs.: Variable cost, $2.20 Fixed cost, $3.50 Actual Costs 2,440 Ibs. at $8.30 3,750 hrs. at $17.68 Direct materials Direct labor Factory overhead $8,100 variable cost $13,650 fixed cost

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

a Direct Materials Cost Variance Price variance Direct Materials Price Variance Actual Price Standar... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1737_60615324693fb_708061.xlsx

300 KBs Excel File