Question: Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1: job no. 64 ($84,000) and job

Stellar Sound, Inc., which uses a job-order costing system, had two jobs in process at the start of 20x1: job no. 64 ($84,000) and job no. 65 ($53,500). The following information is available:

a. The company applies manufacturing overhead on the basis of machine hours (based on practical capacity). Budgeted overhead and machine activity for the year were anticipated to be $840,000 and 16,000 hours, respectively.

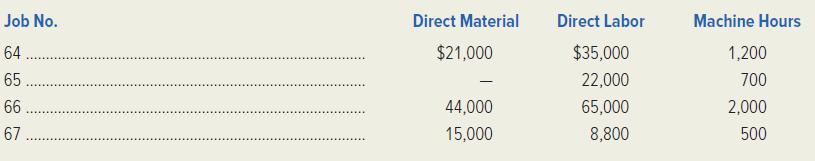

b. The company worked on four jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were as follows:

c. Manufacturing overhead during the first quarter included charges for depreciation ($34,000), indirect labor ($60,000), indirect materials used ($5,000), and other factory costs ($139,500).

d. Stellar Sound completed job no. 64 and job no. 65. Job no. 65 was sold on account, producing a profit of $34,700 for the firm.

Required:

1. Determine the company’s predetermined overhead application rate.

2. Prepare journal entries as of March 31 to record the following.

a. The issuance of direct material to production and the direct labor incurred.

b. The manufacturing overhead incurred during the quarter.

c. The application of manufacturing overhead to production.

d. The completion of jobs no. 64 and no. 65.

e. The sale of job no. 65.

3. Determine the cost of the jobs still in production as of March 31.

4. Did the finished-goods inventory increase or decrease during the first quarter? By how much?

5. Was manufacturing overhead under- or overapplied for the first quarter of the year? By how much?

Job No. 64...... 65 66 67...... Direct Material $21,000 - 44,000 15,000 Direct Labor $35,000 22,000 65,000 8,800 Machine Hours 1,200 700 2,000 500

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

1 2 3 4 Finishedgoods inventory increased by 203000 315250 1... View full answer

Get step-by-step solutions from verified subject matter experts