The following information has been compiled for Quilliam Company. The company is in the office paper products

Question:

The following information has been compiled for Quilliam Company. The company is in the office paper products industry.

● Projected cash and credit sales schedule:

● Collection policy for credit sales: 30% in month of sale; 60% in subsequent month. Remaining 10% are uncollectible and written off 2 months after sale. There is a 1% cash discount on the 30% credit sales collected in the month of sale.

● Gross profit ratio is 40% of sales. The inventory policy is to have 10% of the next month’s sales in units (safety stock) available at the end of each month. All purchases are on credit. Half are paid in the same month that the purchase is made, and the other half in the month following the purchase.

● Selling and administrative salaries for September of $63,000 will be paid in October. Accrued salaries from September of $12,000 will also be paid in October.

● Buildings have a useful life of 8 years and a cost of $128,000. Equipment has a useful life of 4 years and a cost of $80,000. Land with a book value of $15,000 is projected to be sold for $12,000 in October.

● Cash will be used to buy a 3-month insurance policy on October 1 for $10,500. Supplies of $1,100 will be purchased on October 15. Supplies on January 31 were $1,700 and are projected to be $300 on October 28. Rent per month (paid at the end of each month) is $9,000. Advertising costs for October (will be paid) are expected to be $10,000.

● Unearned revenue from January of $1,400 will be earned in October.

● Cash dividends of $3,800 were declared in October and will be paid on October 10. Stock with a par value of $500 is projected to be issued in October for $7,000.

● The cash balance on September 30 was $4,000. The October scheduled debt payment of $18,000 includes $10,000 of interest.

● For simplicity, ignore taxes and the minimum desired cash balance.

The following budgets have been prepared and are given here:

● October operating cash budget, including cash receipts and cash disbursements

● October income statement

● October partial financial budget: cash flow from investing and financing activities

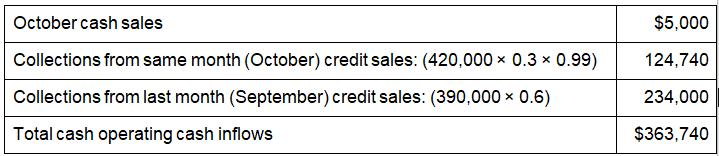

October budgeted cash receipts from operations:

Inventory budgeted purchases and payments of accounts payable:

October budgeted payments to suppliers= ½ (256,200 + 238,260) = $247,230

Other budgeted operating cash outflows: Budgeted investing and financing activities:

Ending budgeted cash balance: $4,000 + $363,740 – $247,230 – $115,600 + $7,200 = $12,110

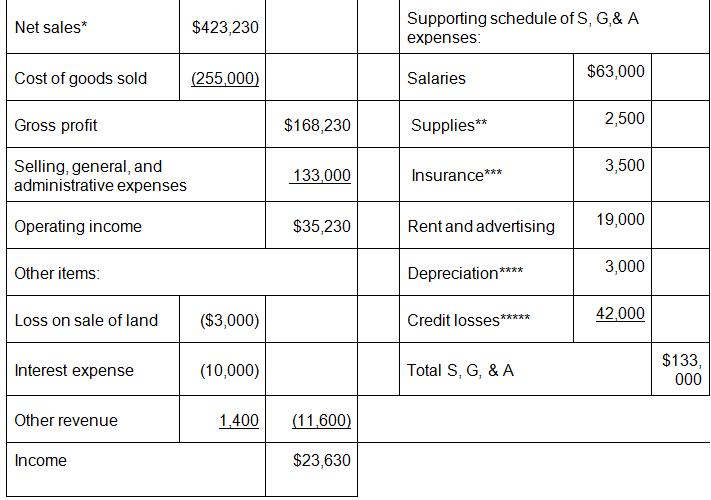

October budgeted income statement:

* Net sales = 425,000 – (0.01 × 420,000 × 0.3) = $423,230

** Supplies = 1,700 + 1,100 – 300 = 2,500

*** Insurance= 10,500 ÷ 3

**** Depreciation = 1/12 ((128,000 ÷ 8) + (80,000 ÷ 4))

***** Credit losses = 420,000 × 0.1

a. Analyze all of the budgets and supporting calculations. How should the company use this information?

b. What other information would be useful if you were the chief financial officer of the company?

c. This chapter focuses primarily on the manual preparation of the master budget. Technologies such as RPA, Blockchain, 5G, and SAP HANA allow for online real-time reporting. Identify the costs and benefits of moving to an automated budgeting process.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope