Question: This problem extends the Summary Problem 1 to a second department. During May, Florida Tile Industries reports the following in its Tile-Finishing Department: Requirements: 1.

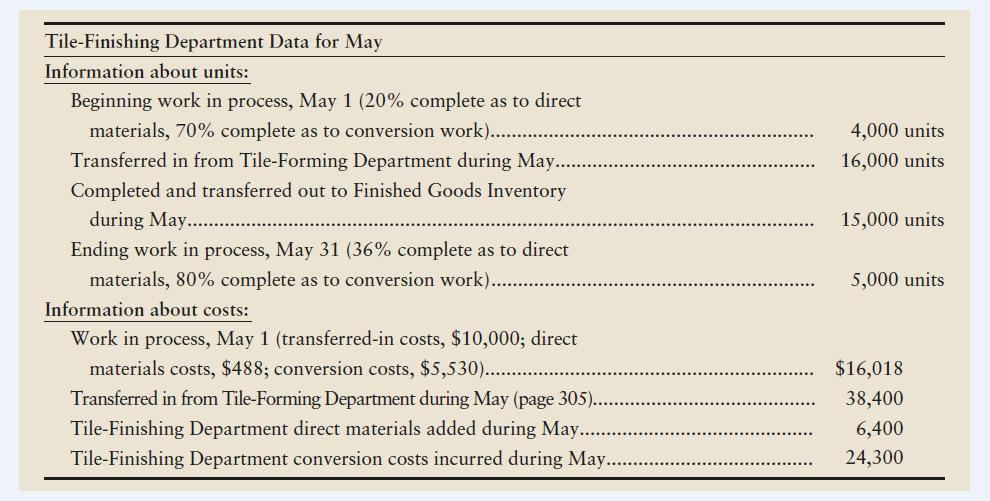

This problem extends the Summary Problem 1 to a second department. During May, Florida Tile Industries reports the following in its Tile-Finishing Department:

Requirements:

1. Complete the five-step process costing procedure to assign the Tile-Finishing Department’s total costs to account for to units completed and to units in ending work in process inventory.

2. Make the journal entry to transfer the appropriate amount of cost to Finished Goods Inventory.

3. What is the cost of making one unit of product from start to finish?

Tile-Finishing Department Data for May Information about units: Beginning work in process, May 1 (20% complete as to direct materials, 70% complete as to conversion work).... Transferred in from Tile-Forming Department during May.. 4,000 units 16,000 units Completed and transferred out to Finished Goods Inventory during May....... 15,000 units Ending work in process, May 31 (36% complete as to direct materials, 80% complete as to conversion work). 5,000 units Information about costs: Work in process, May 1 (transferred-in costs, $10,000; direct materials costs, $488; conversion costs, $5,530)... Transferred in from Tile-Forming Department during May (page 305).. Tile-Finishing Department direct materials added during May. Tile-Finishing Department conversion costs incurred during May..... $16,018 38,400 6,400 24,300

Step by Step Solution

There are 3 Steps involved in it

1 Step 1 and 2 Summarize the flow of physical units calculate ... View full answer

Get step-by-step solutions from verified subject matter experts