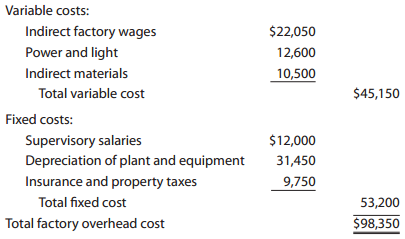

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the

Question:

During May, the department operated at 7,400 standard hours, and the factory overhead costs incurred were indirect factory wages, $23,580; power and light, $13,120; indirect materials, $11,310; supervisory salaries, $12,000; depreciation of plant and equipment, $31,450; and insurance and property taxes, $9,750. Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 7,400 hours.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: