Question: Use the Lucenay Interiors data from Problem 16-42B. Requirements 1. Prepare Lucenay Interiors' income statement for the year ended December 31, 2008. Use the single-step

Use the Lucenay Interiors data from Problem 16-42B.

Requirements

1. Prepare Lucenay Interiors' income statement for the year ended December 31, 2008. Use the single-step format, with all revenues listed together and all expenses together,

2. Prepare Lucenay's balance sheet at December 31, 2008.

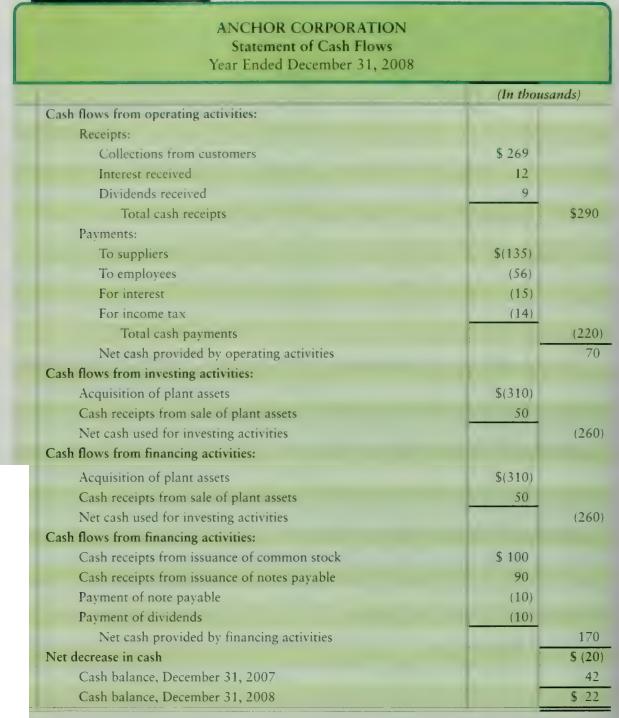

3. Prepare Lucenay's statement of cash flows for the year ended December 31, 2008. Format cash flows from operating activities by the direct method, as shown in Exhibit 16A-3.

Exhibit 16A-3

Problem 16-42B

Lucenay Interiors, a furniture store, was formed on January l, 2008, when lucenay issued common stock for \($400,000.\) Early in January, Lucena) made the following cash payments:

a. \($100,000\) for equipment

b. \($260,000\) for inventory

c. \($20,000\) for 2008 rent expense on a store building

Later in the year, Lucenay purchased inventory on account. Cost of this inventory was \($120,000.\) Before year-end, Lucenay paid \($60,000\) of this debt. During 2008, Lucenay sold 2,000 units of inventory for \($200\) each. Before year end, Lucenay collected 80% of this amount. Cost of goods sold for the year was \($260,000\) and at year-end the inventory balance was \($120,000.

The\) store employs a salesperson whose annual pay is \($45,000,\) of which Lucenay owes \($4,000\) at year-end. At the end of the year, Lucenay paid income tax of \($10,000.

Late\) in 2008, Lucenay paid cash dividends of \($1\) 1,000. For equipment, Lucenay uses the straight-line depreciation method, over 5 years, with zero residual value.

ANCHOR CORPORATION Statement of Cash Flows Year Ended December 31, 2008 Cash flows from operating activities: Receipts: Collections from customers Interest received Dividends received Total cash receipts Payments: To suppliers To employees For interest For income tax (In thousands) $269 12 9 $290 $(135) (56) (15) (14) (220) 70 Total cash payments Net cash provided by operating activities Cash flows from investing activities: Acquisition of plant assets Cash receipts from sale of plant assets Net cash used for investing activities Cash flows from financing activities: Acquisition of plant assets Cash receipts from sale of plant assets Net cash used for investing activities Cash flows from financing activities: Cash receipts from issuance of common stock Cash receipts from issuance of notes payable Payment of note payable Payment of dividends Net cash provided by financing activities Net decrease in cash $(310) 50 (260) $(310) 50 (260) $ 100 90 (10) (10) 170 Cash balance, December 31, 2007 Cash balance, December 31, 2008 $ (20) 42 $ 22

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts