Question: Walton Ltd. is considering replacing an existing machine with a new and faster machine that will produce a more reliable product (i.e., better tolerances). The

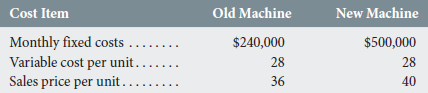

Walton Ltd. is considering replacing an existing machine with a new and faster machine that will produce a more reliable product (i.e., better tolerances). The switch to a new machine resulting in a superior product is expected to allow Walton to increase its sale price for the product. The switch will increase fixed costs, but not the variable costs. The cost and revenue estimates are as follows:

Required:

1. Determine the break-even point in units for the two machines.

2. Determine in units the sales level at which the new machine will achieve a 10% target profit-to-sales ratio (ignore taxes).

3. Determine the sales level at which profits will be the same for either the old or the new machine.

4. Which machine represents a lower risk if demand is uncertain? Explain.

Cost Item New Machine Old Machine Monthly fixed costs Variable cost per unit.. Sales price per unit.. $240,000 28 36 $500,000 28 40

Step by Step Solution

3.25 Rating (166 Votes )

There are 3 Steps involved in it

1 Old New Fixed costs 240000 500000 Unit contribution margin 800 1200 Breakeven sales unitsrounded u... View full answer

Get step-by-step solutions from verified subject matter experts