You have been asked to prepare the monthly cash budget for June and July for the Merchandise

Question:

You have been asked to prepare the monthly cash budget for June and July for the Merchandise and Mercantile Company. The company sells a unique product that is specially made for it by a major product manufacturer. The selling price is $16 per unit. All sales are on account.

Merchandise purchases are also on account. The policy of the company is to purchase sufficient quantity of product to ensure that each month?s ending inventory is 50% of the following month?s expected sales quantity.

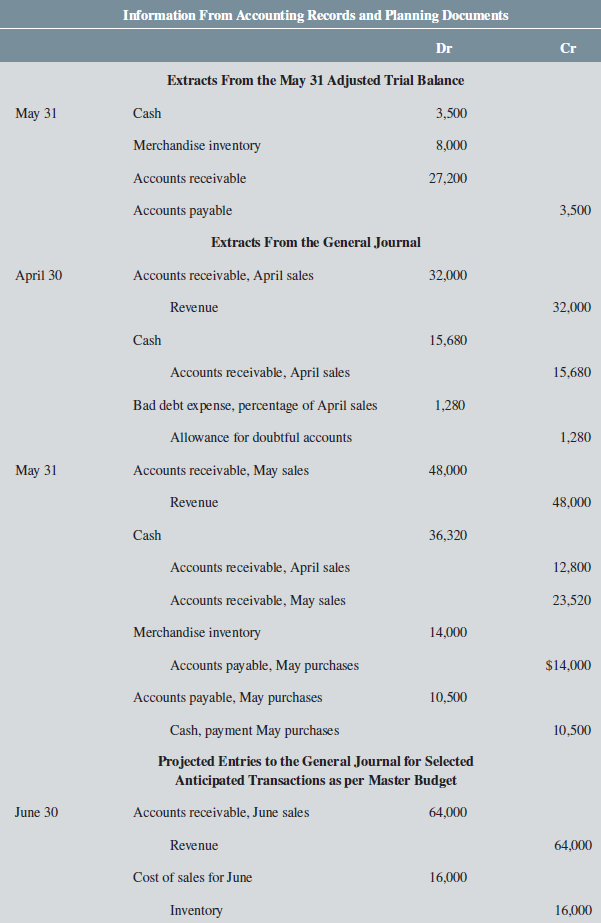

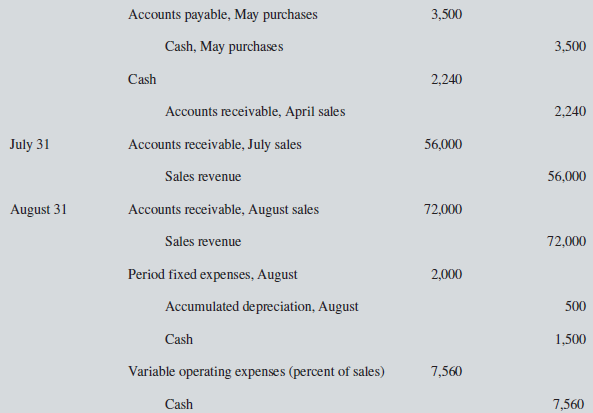

The assignment file contains extracts from the general journal showing the journal entries pertaining to certain relevant transactions that have occurred and a set of entries the bookkeeper has provided that indicate the transactions expected to occur affecting cash, accounts payable, accounts receivable, and merchandise inventory accounts due to the projected sales revenues and projected merchandise purchases on the master budget. This analysis, with other additional data, is shown below. Assume today is May 31, 20X1, and that all dollar amounts arein thousands of dollars.

Required:

1. Calculate the cost per unit of merchandise inventory

2. Prepare a schedule showing the quantity of sales, ending inventory, beginning inventory and the quantity of product purchased in May, June, and July.

3. Use the price per unit of inventory purchased and the quantity purchased to determine the expenditure for purchases in May, June, and July.

4. Calculate the percentages of sales the company expects to collect in the month of the sale and in the two months following the sale. What is the percentage of uncollectible sales? Assume that the percentages calculated for the month for which data is provided also apply to sales for any month of the year.

5. Calculate the percentages of May and June merchandise purchases the company expects to pay in June.

6. Calculate the balance in the accounts receivable on June 30. Assume all receivables are due to sales on account.

7. Calculate the balance in the cash account on June 30, based on the transactions projected to occur in June. Use the collection and disbursement percentages previously calculated. Assume that fixed expenses occur evenly in each month of the year.

8. Prepare a cash budget for July, in good form. Use the collection and disbursement percentages previously calculated.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan