Due to the huge supply of yen, the funding bias for USD/JPY is such that it is

Question:

Due to the huge supply of yen, the funding bias for USD/JPY is such that it is cheaper to borrow yen versus dollars (i.e.sJPY BRL ≠ 0) Consider now a cross currency swap with one leg paying floating in yen (with no spread) and the other paying floating in Brazilian reais plus a spread s*. What would the fair value spread s* be?

Section 12.2.1

Transcribed Image Text:

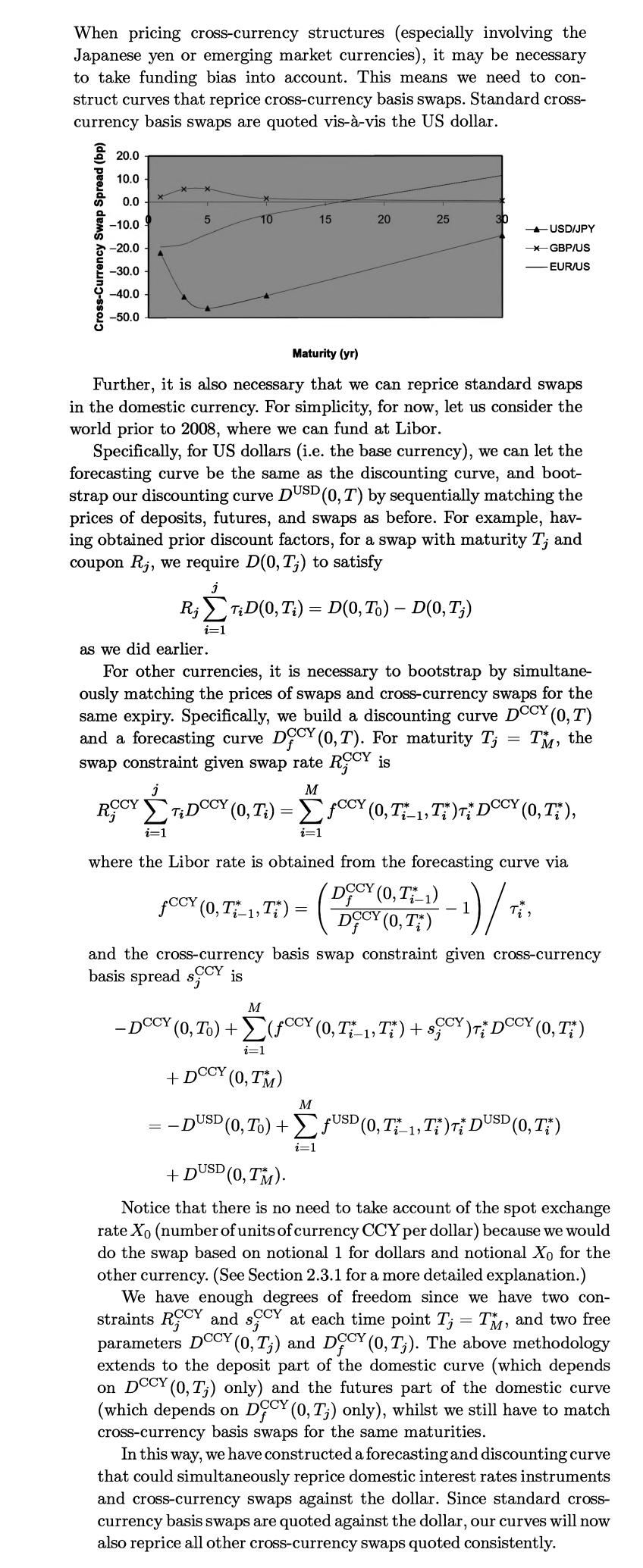

When pricing cross-currency structures (especially involving the Japanese yen or emerging market currencies), it may be necessary to take funding bias into account. This means we need to con- struct curves that reprice cross-currency basis swaps. Standard cross- currency basis swaps are quoted vis-à-vis the US dollar. Cross-Currency Swap Spread (bp) 20.0 10.0 0.0 -10.09 -20.0 -30.0 -40.0 -50.0 5 10 -DCCY Maturity (yr) Further, it is also necessary that we can reprice standard swaps in the domestic currency. For simplicity, for now, let us consider the world prior to 2008, where we can fund at Libor. Specifically, for US dollars (i.e. the base currency), we can let the forecasting curve be the same as the discounting curve, and boot- strap our discounting curve DUSD (0, T) by sequentially matching the prices of deposits, futures, and swaps as before. For example, hav- ing obtained prior discount factors, for a swap with maturity T; and coupon Rj, we require D(0, T;) to satisfy j Rj Σ¹¡D(0, T;) = D(0, To) — D(0, T;) i=1 15 as we did earlier. For other currencies, it is necessary to bootstrap by simultane- ously matching the prices of swaps and cross-currency swaps for the same expiry. Specifically, we build a discounting curve DCCY (0, T) and a forecasting curve DCCY (0,7). For maturity T; swap constraint given swap rate RCCY is TM, the - DUSD 20 j M CCY ROCYTDCCY (0, T₁) = Σ £ccY (0, T-1, T )T DCCY (0, Ti ), i=1 i=1 25 where the Libor rate is obtained from the forecasting curve via fccy (0, T₁-1, T) bycx (0, 17) - 1) / 2, DCCY and the cross-currency basis swap constraint given cross-currency basis spread SCCY is (0, To) + M (0, To) + (CCY (0, T₁-1, Tr) + SCY) T₂ DCCY (0, T*) i=1 + DCCY (0, TM) M -USD/JPY --GBP/US -EUR/US i=1 ƒUSD (0, Ti-1, Ti* ) Ti DUSD D(0, Ti) + DUSD (0, TM). Notice that there is no need to take account of the spot exchange rate Xo (number of units of currency CCY per dollar) because we would do the swap based on notional 1 for dollars and notional Xo for the other currency. (See Section 2.3.1 for a more detailed explanation.) We have enough degrees of freedom since we have two con- straints RCCY and SCCY at each time point T; = TM, and two free parameters DCCY (0,T;) and DCCY (0, Tj). The above methodology extends to the deposit part of the domestic curve (which depends on DCCY (0,T;) only) and the futures part of the domestic curve (which depends on DCCY (0,T;) only), whilst we still have to match cross-currency basis swaps for the same maturities. In this way, we have constructed a forecasting and discounting curve that could simultaneously reprice domestic interest rates instruments and cross-currency swaps against the dollar. Since standard cross- currency basis swaps are quoted against the dollar, our curves will now also reprice all other cross-currency swaps quoted consistently.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

In order to determine the fair value spread s for the crosscurrency swap we need to consider the fun...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Write a method that displays an n-by-n matrix using the following header:public static void printMatrix(int n)Each element is 0 or 1, which is generated randomly. Write a test program that prompts...

-

What is the key difference between simple group structures and complex group structures that affects the consolidation process? O None of the listed choices. O Simple group structures have fewer...

-

Use the algorithm described in Sec. 10.3 to find the shortest path through each of the following networks, where the numbers represent actual distances between the corresponding nodes. (a) (b)...

-

Write a static method lg() that takes an int argument n and returns the largest integer not larger than the base-2 logarithm of n. Do not use the Math library.

-

The return on assets for Corwin Corporation is 7.6%. During the same year, Corwins return on common stockholders equity is 12.8%. What is the explanation for the difference in the two rates?

-

Find the exact coordinates of the stationary point on the curve y = xe x .

-

Two of your friends just completed a First Screen analysis for an e-commerce site that they hope to launch to sell horse-riding supplies such as saddles, lead ropes, and feed buckets. They are...

-

On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the first few days of July follow. INSTRUCTIONS 1. Record the transactions on page 1 of the general...

-

Part A A string that is 9.6 m long is tied between two posts and plucked. The string produces a wave that has a frequency of 320 Hz and travels with a speed of 192 m/s. How many full wavelengths of...

-

Consider a flat Libor discount curve given by D(0, T) =e 0.03T . Suppose that the OIS discount curve is D (0,T) = e 0.028T . Compute the swap rate (annual fixed coupons, semi-annual floating coupons)...

-

Consider the equation for the par swap rate under OIS discounting in Section 12.1.3. If the OIS-Libor spread is zero, show that this reduces to the classical equation D(0,T 0 ) D (0, T N ) = Suppose...

-

A credit-rating agency assigns ratings to corporate bonds. The agency rates bonds offered to companies that are most likely to honor their liabilities AAA. The ratings fall as the company becomes...

-

What can shift the intertemporal budget line, IBL? What happens to current and future consumption when IBL shifts occur?

-

What happens in a fixed exchange rate regime if a currency is overvalued? What problem can this create?

-

Why is a theory of consumption also a theory of saving?

-

What do indifference curves show about current and future consumption? Why do they slope downward? Why are they convex?

-

How do changes in the real interest rate affect the IBL and current and future consumption?

-

The following table shows some financial data for two companies: A B Total Asset $1,552.10 $1,565.70 EBITDA -60 70 Net Income + interest -80 24 Total Liabilities 814 1537.10 1. Calculate which has...

-

Let (X. A. p) be a measure space. Show that for any A,B A, we have the equality: (AUB)+(An B) = (A) + (B).

-

Below is the numbered skeleton of trans-decalin: Identify whether each of the following substituents would be in an equatorial position or an axial position: (a) A group at the C-2 position, pointing...

-

The following reaction is very slow: (a) Identify the mechanism. (b) Explain why the reaction is so slow. (c) When hydroxide is used instead of water, the reaction is very rapid. Draw the mechanism...

-

Consider the structure of the following compound: (a) When this compound is treated with bromine under conditions that favor monobromination, two stereoisomeric products are obtained. Draw them, and...

-

At the end of the current period, a company checks its physical inventory against its records and discovers the following. 1,700 units (products) were in the warehouse. 23 of the 1,700 units in the...

-

The following cost data relate to the manufacturing activities of Chang Company during the just completed year: Manufacturing overhead costs incurred: Indirect materials Indirect labor Property...

-

Purple Reign is a clothing manufacturer/retailer based in Minneapolis, MN. The company started by making and selling t-shirts with images of the musician Prince on them. Business picked up and the...

Study smarter with the SolutionInn App