A simple trust has the following receipts and expenditures for 2018. The trust instrument is silent with

Question:

A simple trust has the following receipts and expenditures for 2018. The trust instrument is silent with respect to capital gains, and state law concerning trust accounting income follows the Uniform Act. Assume the trustee's fee is charged equally to income and to principal.

Corporate bond interest . . . . . . . . . . . . . . . 40,000

Tax-exempt interest . . . . . .. . . . . . .. . . . . . . $9,000

Long-term capital gain . . . . . .. . . . . . .. . . . . 5,000

Trustee's fee . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000

Distribution to beneficiary . . . . . . . . . . . . .48,000

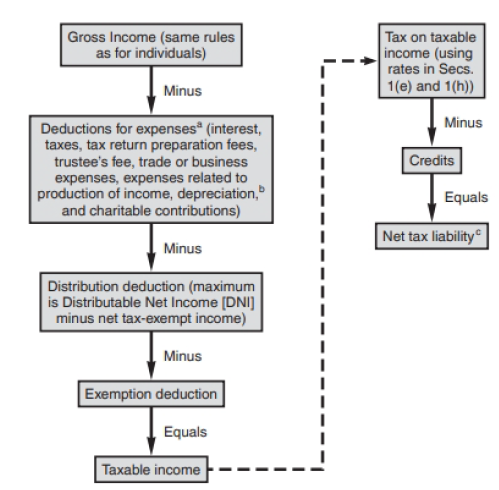

a. What is the trust's taxable income under the formula approach of Figure C:14-1?

b. What is the trust's tax liability?

Figure C:14-1:

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf