John Lawrence Bailey is employed in Country T by American Conglomerate Corporation. Bailey has resided with his

Question:

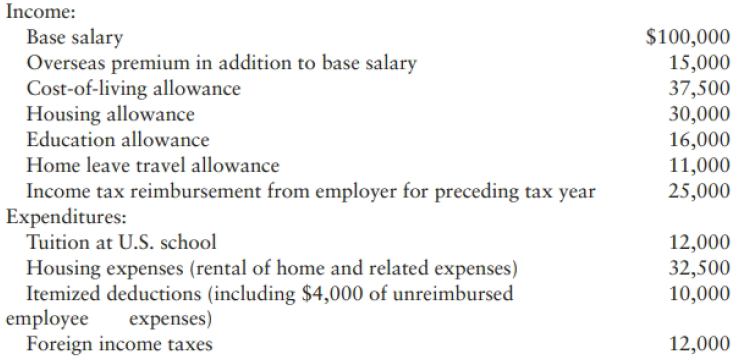

John Lawrence Bailey is employed in Country T by American Conglomerate Corporation. Bailey has resided with his wife and three children in Country T for seven years. He made one five-day business trip back to the United States in the current year, and $2,000 of his salary (but none of the allowances) is allocable to the U.S. business trip. Bailey reports the following tax-related information for the current year:

Complete a 2017 Form 2555 for the Baileys' current tax year. Assume Mr. Bailey established foreign residency in 2013, and all prior tax returns were filed with a Form 2555 claiming that Mr. Bailey was a bonafide foreign resident.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted: