Using the facts from Problem C:8-67 below, calculate the tax liabilities of Flying Gator and T Corporations

Question:

Using the facts from Problem C:8-67 below, calculate the tax liabilities of Flying Gator and T Corporations for 2017. How much larger (or smaller) would be the total of the two separate return tax liabilities if they were to file separate tax returns than the affiliated group's consolidated return tax liability? What taxes are due (or refund available) if Flying Gator made $125,000 of estimated tax payments and T Corporation made $25,000 of estimated tax payments?

Data from C:8-67:

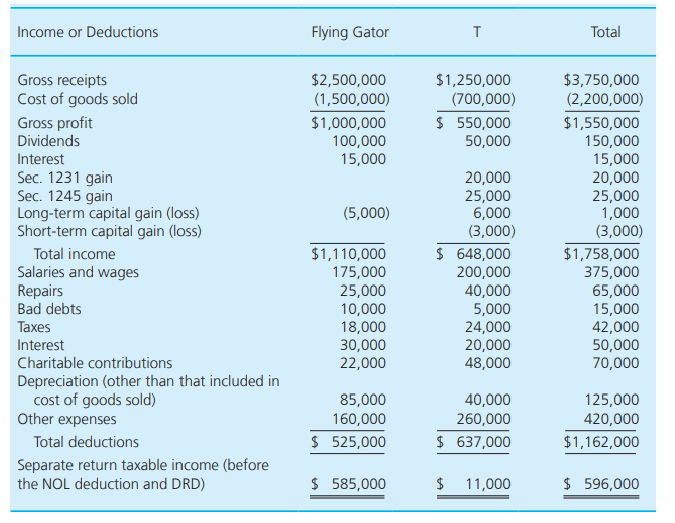

Flying Gator Corporation and its 100%-owned subsidiary, T Corporation, have filed consolidated tax returns for many years. Both corporations use the hybrid method of accounting and the calendar year as their tax year. During 2017 (which is the current year for this problem), they report the operating results as listed in Table C:8-2. Note the following additional information:

• Flying Gator and T Corporations are the only members of their controlled group.

• Flying Gator's address is 2101 W. University Ave., Gainesburg, FL 32611. Its employer identification number is 38-2345678. Flying Gator was incorporated on June 11, 2005. Its total assets are $430,000.

• A $50,000 consolidated NOL carryover from the preceding year is available. The NOL is wholly attributable to Flying Gator.

• Flying Gator and T use the first-in, first-out (FIFO) inventory method. T began selling inventory to Flying Gator in the preceding year, which resulted in a $40,700 deferred intercompany profit at the end of the preceding year. Flying Gator is deemed to realize this profit in the current year because it uses the FIFO method. During the current year,

T sells additional inventory to Flying Gator, realizing a $300,000 profit. At the end of the current year, Flying Gator holds inventory responsible for $45,100 of this profit.

• Flying Gator receives all its dividends from T. T receives all its dividends from a 60%owned domestic corporation. All distributions are from E&P.

• For 2017, the dividends-received deduction percentage is 80% if the shareholder corporation owns at least 20% but less than 80% of the distributing corporation's stock.

• Flying Gator receives all its interest income from T. T pays Flying Gator the interest on March 31 of the current year on a loan that was outstanding from October 1 of the preceding year through March 31 of the current year. Flying Gator and T did not accrue any interest at the end of the preceding year because they use the hybrid method of accounting. T pays $5,000 of its interest expense to a third party.

• Officer's salaries are $80,000 for Flying Gator and $65,000 forT. These amounts are included in salaries and wages in Table C:8-2.

• Flying Gator's capital losses include a $9,000 long-term loss on a sale of land to T in the current year. T holds the land at year-end.

• The corporations have no nonrecaptured net Sec. 1231 losses from prior tax years.

• Ignore the U.S. production activities deduction.

• Estimated tax payments for the current year are $150,000.

• Use a 34% flat tax rate for 2017, regardless of taxable income.

Table C: 8-2:

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf