Consider a Constant Maturing Swap (CMS) caplet whose payoff at payment date T p takes the form

Question:

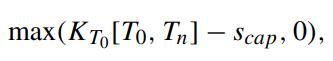

Consider a Constant Maturing Swap (CMS) caplet whose payoff at payment date Tp takes the form

where the par swap rate over the tensor {T0, ··· ,Tn} is set at T0,Tp > T0 and scap is some pre-set constant cap value. As usual, {T0, ··· ,Tn−1} are the reset dates at which the relevant LIBOR {L0, ··· ,Ln−1} are determined. Using the annuity B̂(t; T0,Tn) as the numeraire, show that the time-t value of the CMS caplet is given by

where the par swap rate over the tensor {T0, ··· ,Tn} is set at T0,Tp > T0 and scap is some pre-set constant cap value. As usual, {T0, ··· ,Tn−1} are the reset dates at which the relevant LIBOR {L0, ··· ,Ln−1} are determined. Using the annuity B̂(t; T0,Tn) as the numeraire, show that the time-t value of the CMS caplet is given by![= VCMS(t; To, Tn) B(t; To, Tn) Eso.n max(KTo [To, Tn] - Scap, 0)B(To, Tp) - B (To: To, Tn)](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/5/1/541655de215b7be81700651542141.jpg)

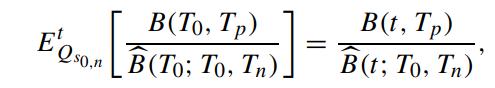

where Qs0,n is the swap measure with the annuity numeraire. Using the relation

express VCMS(t; T0,Tn) in terms of the price function of a European swaption plus a convexity adjustment term due to payment of the caplet payoff at a later date Tp. Determine the form of this convexity adjustment.

express VCMS(t; T0,Tn) in terms of the price function of a European swaption plus a convexity adjustment term due to payment of the caplet payoff at a later date Tp. Determine the form of this convexity adjustment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: