Explain why the sum of prices of the call-on-a-call and call-on-a-put is equal to the price of

Question:

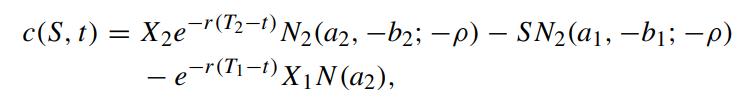

Explain why the sum of prices of the call-on-a-call and call-on-a-put is equal to the price of the call with expiration T2. Show that the price of a European call-on-a-put is given by 3 Option Pricing Models: Black–Scholes–Merton Formulation

where a1,b1,a2 and b2 are defined in Sect. 3.4.4

where a1,b1,a2 and b2 are defined in Sect. 3.4.4

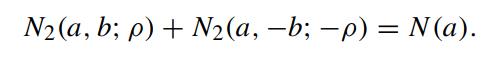

Use the relation

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: