Let F S U denote the Singaporean currency price of one unit of U.S. currency and F

Question:

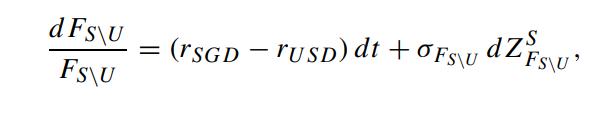

Let FS\U denote the Singaporean currency price of one unit of U.S. currency and FH\S denote the Hong Kong currency price of one unit of Singaporean currency. We may interpret FS\U as the price process of a tradeable asset in Singaporean currency. Assume FS\U to be governed by the following dynamics under the risk neutral measure QS in the Singaporean currency world:

where rSGD and rUSD are the Singaporean and U.S. riskless interest rates, respectively. The digital quanto option pays one Hong Kong dollar if FS\U is above the strike level X. Find the value of the digital quanto option in terms of the riskless interest rates of the different currency worlds and volatility values σFS\U and σFH\S. Recalculate the digital quanto option if it pays one Hong Kong dollar when FS\U > αFH\U , where α is a fixed constant and FH\U is the Hong Kong currency price of one unit of U.S. currency. Hint: FH\U = FH\SFS\U.

where rSGD and rUSD are the Singaporean and U.S. riskless interest rates, respectively. The digital quanto option pays one Hong Kong dollar if FS\U is above the strike level X. Find the value of the digital quanto option in terms of the riskless interest rates of the different currency worlds and volatility values σFS\U and σFH\S. Recalculate the digital quanto option if it pays one Hong Kong dollar when FS\U > αFH\U , where α is a fixed constant and FH\U is the Hong Kong currency price of one unit of U.S. currency. Hint: FH\U = FH\SFS\U.

Step by Step Answer: