Let the exchange rate process X(t), T -maturity domestic and foreign bond processes B d (t, T

Question:

Let the exchange rate process X(t), T -maturity domestic and foreign bond processes Bd (t, T ) and Bf (t, T ) be the same as those defined in Problem 8.9. Find the time-t value of the LIBOR spread option which pays at time T + δ

![a [La (T; 8) - Lf (T; 8)],](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/7/571655dab83c22a51700637571355.jpg)

where t f (T ; δ) are the domestic and foreign LIBORs over the time interval (T, T + δ], respectively, observed at time T.

Problem 8.9.

Let X(t) denote the exchange rate process in units of the domestic currency per one unit of the foreign currency, and let rd (t) and rf (t) denote the domestic and foreign riskless interest rate, respectively. Also, let Bd (t, T) and Bf (t, T) denote the T-maturity domestic and foreign bond price processes, respectively, t ≤ T . Under the domestic risk neutral measure Qd , the dynamics of X(t) and Bd (t, T′) are governed by

![dX(t) n = X(1) {[tra(1) r(0)] dr + o{(1) dz{{1}} i=1 Barrawa+Eranazion] 1(t) dt + o(t, T) dZi (t) d Ba(t,](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/4/350655d9eeeac7f61700634350054.jpg)

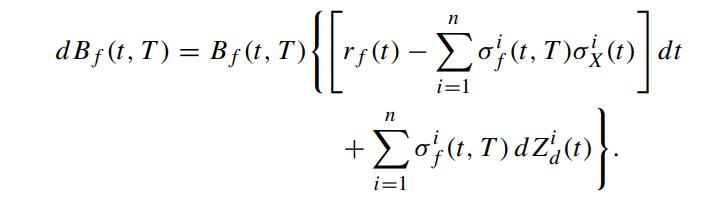

where (Z1d (t)···Znd (t))T is an n-dimensional Brownian process under Qd. Let (σ1f (t, T )··· σnf (t, T ))T be the vector volatility function of Bf (t, T). Show that the dynamics of Bf (t, T) under Qd is given by

By using the T-maturity domestic bond price Bd (t, T) as the numeraire, find the Radon–Nikodym derivative that effects the change of measure from Qd to the T -maturity domestic forward measure QTd . Solve for the solution of the exchange rate process (Nielsen and Sandmann, 2002).

By using the T-maturity domestic bond price Bd (t, T) as the numeraire, find the Radon–Nikodym derivative that effects the change of measure from Qd to the T -maturity domestic forward measure QTd . Solve for the solution of the exchange rate process (Nielsen and Sandmann, 2002).

Step by Step Answer: