Let Y(t; ) denote the yield at time t for a discount bond with a fixed time

Question:

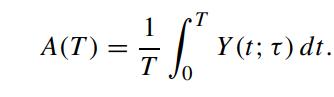

Let Y(t; τ) denote the yield at time t for a discount bond with a fixed time to maturity τ . The average of the constant maturity yield Y(t; τ) over a prespecified time period (0,T ] is given by

We would like to price a European call option on the average yield A(T) whose terminal payoff at time T is given by

![]()

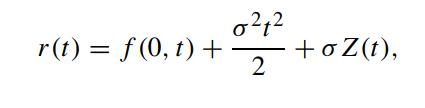

where X is the strike price. We specify the risk neutral dynamics of the short rate process to be the continuous Ho–Lee model, where

where f (0,t) is the initial term structure of the forward rates and Z(t) is a standard Brownian process under the risk neutral measure Q. Show that the price of the average-yield call option at time t,t

![where c(t) = 1_ B(0, 7) e-o (T-1)/6 Eo [e-a [] Z(w) du c(T)], T) TT B(0, t) ( B(0, u) o B(0, u +t) c(T) = max](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/6/502655da75640e621700636501751.jpg)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: