Suppose continuous arithmetic averaging of the asset price is taken from t = 0 to T, T

Question:

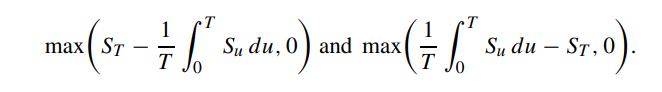

Suppose continuous arithmetic averaging of the asset price is taken from t = 0 to T, T is the expiration time. The terminal payoff function of the floating strike call and put options are, respectively,

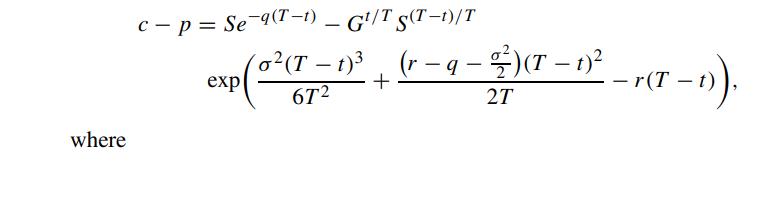

Show that the put-call parity relation for the above pair of European floating strike options is given by

![C-P = Se-9(T-1) where + S (r = q) T At -r(T1) eq(T1)] er(T-1) At, - - = = = [ 5 T Su du.](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/8/9/245655b681dd5c1c1700489240943.jpg)

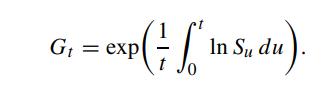

Suppose continuous geometric averaging of the asset price is taken, show that the corresponding put-call parity relation is given by

Transcribed Image Text:

T T max (ST - ² Su du, 0) and max (7" Su du - Sr.0). T T ܘܢ

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To derive the putcall parity relation for European floating strike options lets consider the continu...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the pair of American call and put options with the same time to expiry and on the same underlying asset. Assume the volatility of the asset price to be at most time dependent. Let S C and S...

-

The price of DHM stock is $192 and the following call and put options are actively traded. You decide to analyze the following strategies: Buy the calls to buy the stock at $180 and $210 and sell the...

-

MAG Petroleum is an SME specialising in the sale of lubricants for industrial use. The company, which is owned and operated by Angelina, has just completed its third year operation. During this time,...

-

What is the coefficient of sliding friction and what is a representative value for this coefficient for the brittle crust?

-

Name the four principal financial statements comprising a full set of financial statements.

-

Why have object-oriented databases not replaced relational databases in business information system applications?

-

Defendants Jack and Claire Lein owned and lived on Willow Creek Farm from 1980 through 2004. The farm manager, Stewart, and his girlfriend, plaintiff Tambra Curtis, also lived on the farm during this...

-

Armada Company has these comparative balance sheet data: Additional information for 2010: 1. Net income was $25,000. 2. Sales on account were $375,000. Sales returns and allowances amounted to...

-

In calculating the projected misstatement in monetary unit sampling, accounts with a book value larger than the sampling interval are extended to the projected misstatement at their: Multiple Choice...

-

Show that the put-call parity relations between the prices of floating strike and fixed strike Asian options at the start of the averaging period are given by By combining the above put-call parity...

-

Deduce the following put-call parity relation between the prices of European fixed strike Asian call and put options under continuously monitored geometric averaging c(S, G, t) - P(S, G, t) -r(T-1)...

-

Ross and Jessica are married and have one child who is two years old. Ross is a recent college graduate and works as a software engineer. Jessica is a full-time student at Hendrick College, and...

-

A7.70 F capacitor is charged by a 36.0 V battery. It is disconnected from the battery and then connected to an uncharged 3.10 F capacitor (see the figure ( Figure 1)). Figure C V (a) C C (b) 1 of 1 >...

-

A 2 - cm - diameter solid metal sphere falls steadily at about 1 m / s in 2 0 degree C fresh water. Estimate density of material the sphere made of ?

-

Consider the problem of multiplying two large integers a and b with n bits each (they are so large in terms of digits that you cannot store them in any basic data type like long long int or similar)....

-

You are the financial manager of Toy Store Ltd. The company is planning to introduce a new range of educational toys called the Edu-Fun. The production of the new range will be at the company's...

-

Rainy Ltd is a listed company that operates in the construction industry. On 1 March 2021, Rainy Ltd paid a dividend to its shareholders of $0.20 per share. This dividend is expected to grow...

-

In problem 12.10, you were asked to develop the equation of a regression model to predict the number of business bankruptcies by the number of firm births. For this regression model, solve for the...

-

Would you use the adjacency matrix structure or the adjacency list structure in each of the following cases? Justify your choice. a. The graph has 10,000 vertices and 20,000 edges, and it is...

-

Should boards be held responsible for the results achieved by the organizations they governor is that primarily the responsibility of the CEO and staff?

-

Read The Effect of an Online Self-Assessment Tool on Nonprofit Board Performance by Harrison and Murray. (See Articles.) What types of governance issues did the respondents perceive as most...

-

Read The Effect of an Online Self-Assessment Tool on Nonprofit Board Performance by Harrison and Murray. What changes in governance behavior and practices were reported by the survey respondents...

-

To solve this model economy, we reformulate the competitive equilibrium into the social planner's problem. First of all, in social planner's problem, all markets must clear, and thus N = Nd = N, and...

-

16. Brenda's Balloon Shop is a price taker, and the table below shows its costs of production. Use it to answer the following questions: Output (balloons Total Cost (dollar per hour) per hour) 0 4 1...

-

$400,000 for a new technology.The lender charges them 36% annually with monthly compounding.The agreement calls for no payment until the end of the first month of the 5th year with equal monthly...

Mathematical Logic And Model Theory A Brief Introduction 2011 Edition - ISBN: 1447121759 - Free Book

Study smarter with the SolutionInn App