Suppose the set of risk neutral measures for a given securities model is nonempty. Show that if

Question:

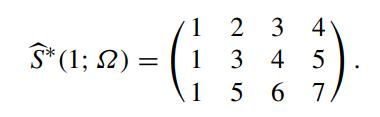

Suppose the set of risk neutral measures for a given securities model is nonempty. Show that if the securities model is complete, then the set of risk neutral measures must be singleton. Consider the following securities model with discounted payoffs of the securities at t = 1 given by the discounted terminal payoff matrix

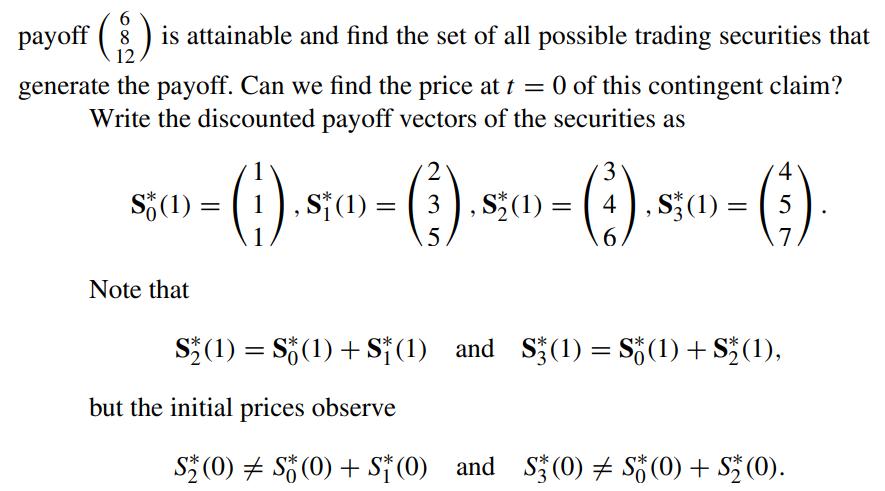

Let the initial price vector Ŝ∗ (0) be (1359). Does the law of one price hold for this securities model? Show that the contingent claim with discounted

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: