We would like to show by heuristic arguments that the American price function P(S,) satisfies the smooth

Question:

We would like to show by heuristic arguments that the American price function P(S,τ) satisfies the smooth pasting condition

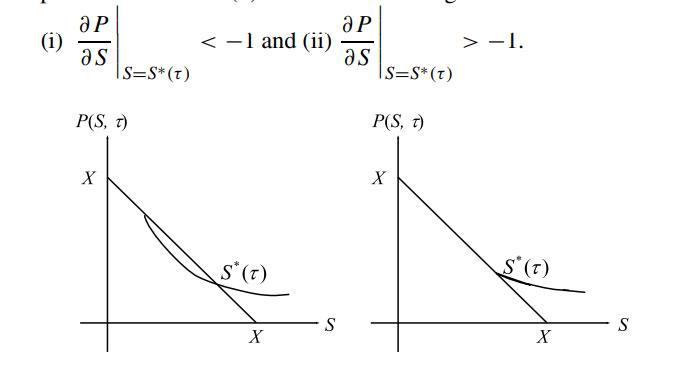

at the optimal exercise price S∗(τ). Consider the behaviors of the American price curve near S∗(τ) under the following two scenarios:

(a) When ∂P/∂S |S=S∗(τ) ∗(τ) falls below the intrinsic value line (see the top left figure).

(b) When ∂P/∂S |S=S∗(τ) > −1, argue why the value of the American put option at asset price level close to S∗(τ) can be increased by choosing a smaller value for S∗(τ) (see the top right figure).

Explain why both cases do not correspond to the optimal exercise strategy of an American put. Hence, the slope of the American put price curve at S∗(τ) must satisfy the smooth pasting condition.

Step by Step Answer: