An investor wishes to invest $10,000 in bonds and gold. He knows that the return on the

Question:

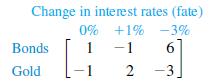

An investor wishes to invest $10,000 in bonds and gold. He knows that the return on the investments will be affected by changes in interest rates. After some analysis, he estimates that the return (in thousands of dollars) at the end of a year will be as indicated in the following payoff matrix:

(A) We assume that fate is a very clever player and will play to reduce the investor’s return as much as possible. Find optimal strategies for both the investor and for “fate.” What is the value of the game?

(B) Find the expected values of the game if the investor continues with his optimal strategy and fate “switches” to the following pure strategies:

(1) Play only 0% change;

(2) Play only +1% change;

(3) Play only -3% change.

Change in interest rates (fate) 0% 1 Bonds Gold -1 +1% -3%. - 1 6 2 -3

Step by Step Answer:

1 3 2 3 Step 1 Convert M into a positive matrix M by adding 4 to each entry in M 5 3 10 36 A Let M 1 M B Maximize subject to Step 2 Set up the two cor...View the full answer

Finite Mathematics For Business Economics Life Sciences And Social Sciences

ISBN: 9780134862620

14th Edition

Authors: Raymond Barnett, Michael Ziegler, Karl Byleen, Christopher Stocker

Students also viewed these Mathematics questions

-

Suppose that the investor in Example 1 wishes to invest $10,000 in long- and short-term bonds, as well as in gold, and he is concerned about inflation. After some analysis, he estimates that the...

-

An investor wishes to invest some or all of his $12.5 million in a diversified portfolio through a commercial lender. The types of investments, the expected interest per year, and the maximum allowed...

-

1. Suppose your personal federal income tax rate is 30%. You are trying to decide which of the following bonds to invest in. Both are BBB rated and therefore equally risky. State of Illinois Bond...

-

What is the MFD? UFD? How are they related?

-

A chimney initially stands upright. It is given a tiny kick, and it topples over. At what point along its length is it most likely to break? In doing this problem, work with the following...

-

1. Why is the operations function important in implementing the strategy of an organization? Explain why the changes put in place by Victoria Chen and her team could either hurt or help the bank. 2....

-

Correlation between Residuals and Explanatory Variables. Consider a generic sequence of pairs of numbers \(\left(x_{1}, y_{1} ight), \ldots,\left(x_{n}, y_{n} ight)\) with the correlation coefficient...

-

Calculating Rates of Return although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2003, Sothebys sold the Edgar Degas bronze sculpture Petite...

-

Required Information [The following Information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Current Year 1 Year Ago 2 Years Ago...

-

You are considering a purchase of a 4-plex, which is located in a desirable neighborhood. The cost of the property is $500,000. Effective rents are expected to average $1500 per month. Every resident...

-

Outline a procedure for solving the 4 5 matrix game without actually solving the game. M = 2 -3 5 -4 -2 -1 6 -6 4 -1 6 0 2 7 3 63 - -7 4 -5

-

Repeat Example 1 for the HDTV game matrix discussed at the beginning of this section: Data from Example 1 Two large shopping centers have competing home-improvement discount stores, Riteway (R) in...

-

Using the information from P6-10B for Castor Corporation, complete Form W-3 that must accompany the companys Form W-2s. Castor Corporation is a 941 payer and is a private, for-profit company. No...

-

Glenda Biggers was the sole shareholder and corporate secretary and Alton Biggers was the president of Clark Warehouses. In January 1993, Clark Warehouses executed a note to the Small Business...

-

cell before his work shift. A few items remained in his old cell: a pair of Adidas shoes, some electronic equipment, and some food. Melvin hid the property and asked the guard to deadlock the cell....

-

Jose Casillas and Robert Houle purchased an older home that had been divided into apartment units. Their initial plan was to renovate and resell the home, but they decided instead to keep it and...

-

Ganci filed a lawsuit against Townsend in July 2010 alleging sexual harassment and intentional infliction of emotional distress. Gancis claims were based, in part, on an alleged sexual assault in the...

-

Larry Henley received Lot 6-A in Soldotna, Alaska, as a gift in 2001. The parcel was a treed lot with no improvements. Lot 6-B was adjacent and directly south of Lot 6-A. Later that year, Henley...

-

Determine the equation of the trend line through the following cost data.Use the equation of the line to forecast cost for year 7. Year Cost ($ millions) 1 .......56 2 .......54 3 .......49 4...

-

What exactly is a prima facie duty? How does an ethic of prima facie duties differ from monistic and absolutist ethical theories?

-

State the null and alternative hypotheses to be investigated with this study. Is hand span a good predictor of how much candy you can grab? Using 45 college students as subjects, researchers set out...

-

Is there an explanatory/response relationship for these variables? Classify the variables in this study as categorical or quantitative. Is hand span a good predictor of how much candy you can grab?...

-

State the two variables measured on each unit. Is hand span a good predictor of how much candy you can grab? Using 45 college students as subjects, researchers set out to explore whether a linear...

-

The Joule-Thomson coefficient, T, is expressed by the following equation; HJT OT (Q3.1) where H is enthalpy. The van der Waals equation of state is given by the following expression; P = V-b V2 a...

-

Hart, Attorney at Law, experienced the following transactions in Year 1 , the first year of operations: Accepted $ 1 7 , 0 0 0 on April 1 , Year 1 , as a retainer for services to be performed evenly...

-

The following T accounts show transactions that were recorded on December 31, 20X1 by Residential Rental Consultant, a firm that specializes in local Housing rentals. The entries for the first...

Study smarter with the SolutionInn App