Many tax preparation firms offer their clients a refund anticipation loan (RAL). For a fee, the firm

Question:

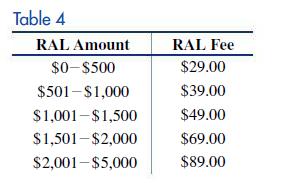

Many tax preparation firms offer their clients a refund anticipation loan (RAL). For a fee, the firm will give a client his refund when the return is filed. The loan is repaid when the IRS refund is sent to the firm. The RAL fee is equivalent to the interest charge for a loan. The schedule in Table 4 is from a major RAL lender. Use this schedule to find the annual rate of interest for the RALs.

A client receives a $475 RAL, which is paid back in 20 days.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Finite Mathematics For Business Economics Life Sciences And Social Sciences

ISBN: 9780134862620

14th Edition

Authors: Raymond Barnett, Michael Ziegler, Karl Byleen, Christopher Stocker

Question Posted: