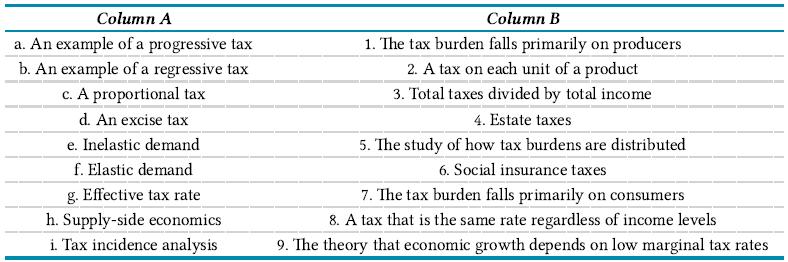

Question: 7. Mat ea concept in Column A with an example in Column B. Column A a. An example of a progressive tax b. An example

7. Mat ea concept in Column A with an example in Column B.

Column A a. An example of a progressive tax b. An example of a regressive tax c. A proportional tax d. An excise tax e. Inelastic demand f. Elastic demand g. Effective tax rate h. Supply-side economics i. Tax incidence analysis Column B 1. The tax burden falls primarily on producers 2. A tax on each unit of a product 3. Total taxes divided by total income 4. Estate taxes 5. The study of how tax burdens are distributed 6. Social insurance taxes 7. The tax burden falls primarily on consumers 8. A tax that is the same rate regardless of income levels 9. The theory that economic growth depends on low marginal tax rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts