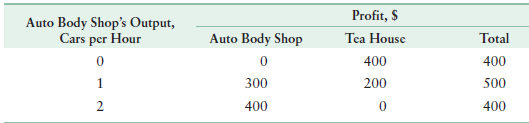

Question: In the example in Table 18.2, suppose that the two parties cannot negotiate. The government imposes a tax on the auto body shop equal to

Table 18.2

Profit, $ Tea House 400 200 Auto Body Shop's Output, Cars per Hour Auto Body Shop Total 400 500 300 400 400

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

The optimal tax in the presence of a negative externality is the tax that equals the cost of the ext... View full answer

Get step-by-step solutions from verified subject matter experts