Question: Reciprocal cost allocation is a common method used to allocate costs to support departments. This method can easily be implemented by the use of circular

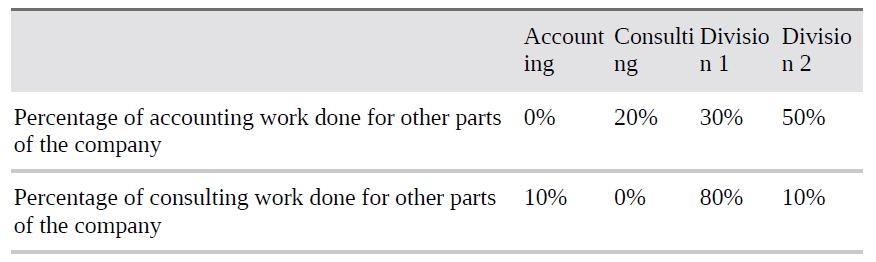

Reciprocal cost allocation is a common method used to allocate costs to support departments. This method can easily be implemented by the use of circular references. To illustrate, suppose Widgetco has two support departments: Accounting and Consulting. Widgetco also has two product divisions: Division 1 and Division 2. Widgetco has decided to allocate $600,000 of the cost of operating the Accounting department and $116,000 of the cost of operating the Consulting department to the two divisions. The fraction of accounting and consulting time used by each part of the company is as follows:

How much of the accounting and consulting costs should be allocated to other parts of the company? To solve this, you need to determine two quantities:

Total Cost Allocated to Accounting This equals $600,000 + .1 * (Total Cost Allocated to Consulting) because 10 percent of all consulting work was done for the Accounting department.

Total Cost Allocated to Consulting A similar equation can be written for this quantity.

You should now be able to calculate the correct allocation of both accounting and consulting costs to each other part of the company.

Account Consulti Divisio Divisio ing ng n 1 n 2 Percentage of accounting work done for other parts 0% of the company Percentage of consulting work done for other parts of the company 10% 20% 0% 30% 80% 50% 10%

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

To calculate the allocation of accounting and consulting costs to other parts of the company we need ... View full answer

Get step-by-step solutions from verified subject matter experts